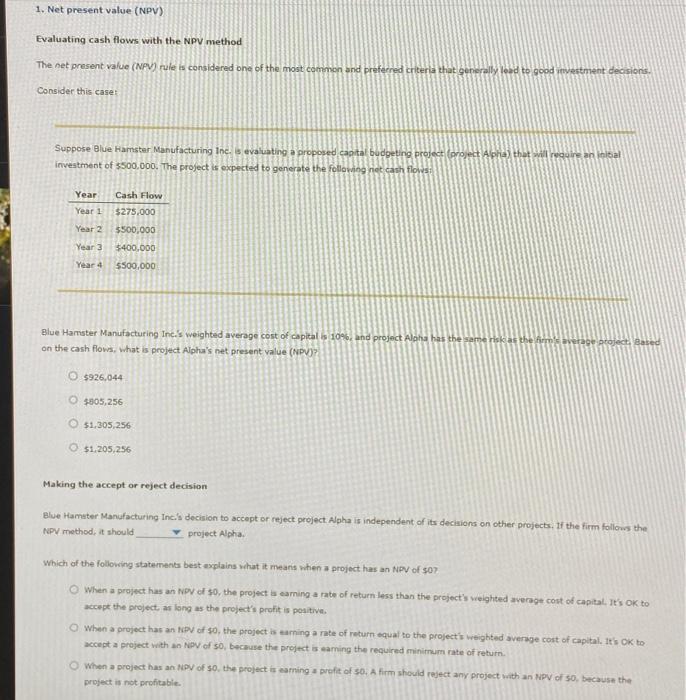

Question: 1. Net present value (NPV) Evaluating cash flows with the NPv method The net present va/ue (NPV) rule is considered one of the most common

1. Net present value (NPV) Evaluating cash flows with the NPv method The net present va/ue (NPV) rule is considered one of the most common and preferred criterla that generally load to good investment decisions. Consider this case Suppose Blue Harmstar Manufacturing Ine. is evaluating a proposed capital budgeting project (propect A pha) that wil recaire an inisal investment of $500,000. The project is expected to generate the following net cant flows: Blue Hamster Manufacturing Inc.'s weighted average cost of capital on the cash flowis, What is project Apha's net present value (NPV)? $926,044$805,256$1,305,256$1,205,256 Making the accept or reject decision Which of the following statementa best wxplains what it mearis when a project has an NPV of SO? When a project has an NoV of \$0, the project a earming a rate of retum less than the project's wreighted averoge cost of capital. It's ok to accept the project, ar lang as the project's pronit is positive. When a project has an tapy of so, the project is earning a rate of return equal to the project' in wighted average cort of capital. It's OK to accept a project with an NPV of so, becmuse the project is eaming the required miniirnem rate of return. When a project has an WDV of s0, the project in earning a prefit of 30. A firm should reject any project with an NPV of so, because the project is not profitable. on the cash floses. what is project Alpha's net present value (Napy)? $926,044$505,256$1,305,256$1,205,256 Making the accept or reject decision Blun Hamster Manufacturing Incis decision to accept or reject project Apha is independent of its decisiors on other projects. tf the firm followe the Nyy method it theuld project Apha. Which of the foliowing s best explains what it means when a project has an fipy of so? When a prod NoV of so, the project is earning a rate of roturn leat than the project'w weighted average cost of capital, tt 's ok to accept the preiect an lone as the proyect's profit i positwe. When a project has an NPV of so, the project is taming a tate of theturn equal to the projectis wheighted werage cost of capital. It's cki to wscept a project with an fibV of so, becaube the project is earning the requirnd minimum rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts