Question: 1 Net Present Value The goal of this exercise is for you to remember the concept of net present value, which is a key tool

Net Present Value

The goal of this exercise is for you to remember the concept of net present value, which is a key tool to understand dynamic models like the ones we will see in class.

A perpetuity. Suppose there is an asset that pays a flow of $ every period including the period when you purchased it Suppose that the interest rate at which you can borrow and lend money is

a What is the NPV of the asset's flows? Call it

b How would your answer change if the asset only started paying the next period? Call it

c Consider the asset in b What is the NPV of the asset if the flow is and the interest rate is How does your answer change when the flow increases? And when the interest rate increases?

d Now consider again the asset in question b How much would you be willing to pay for it today? Why?

e Consider again the asset in b How much would you be willing to pay for it today, if the sequence of interest rates is dots

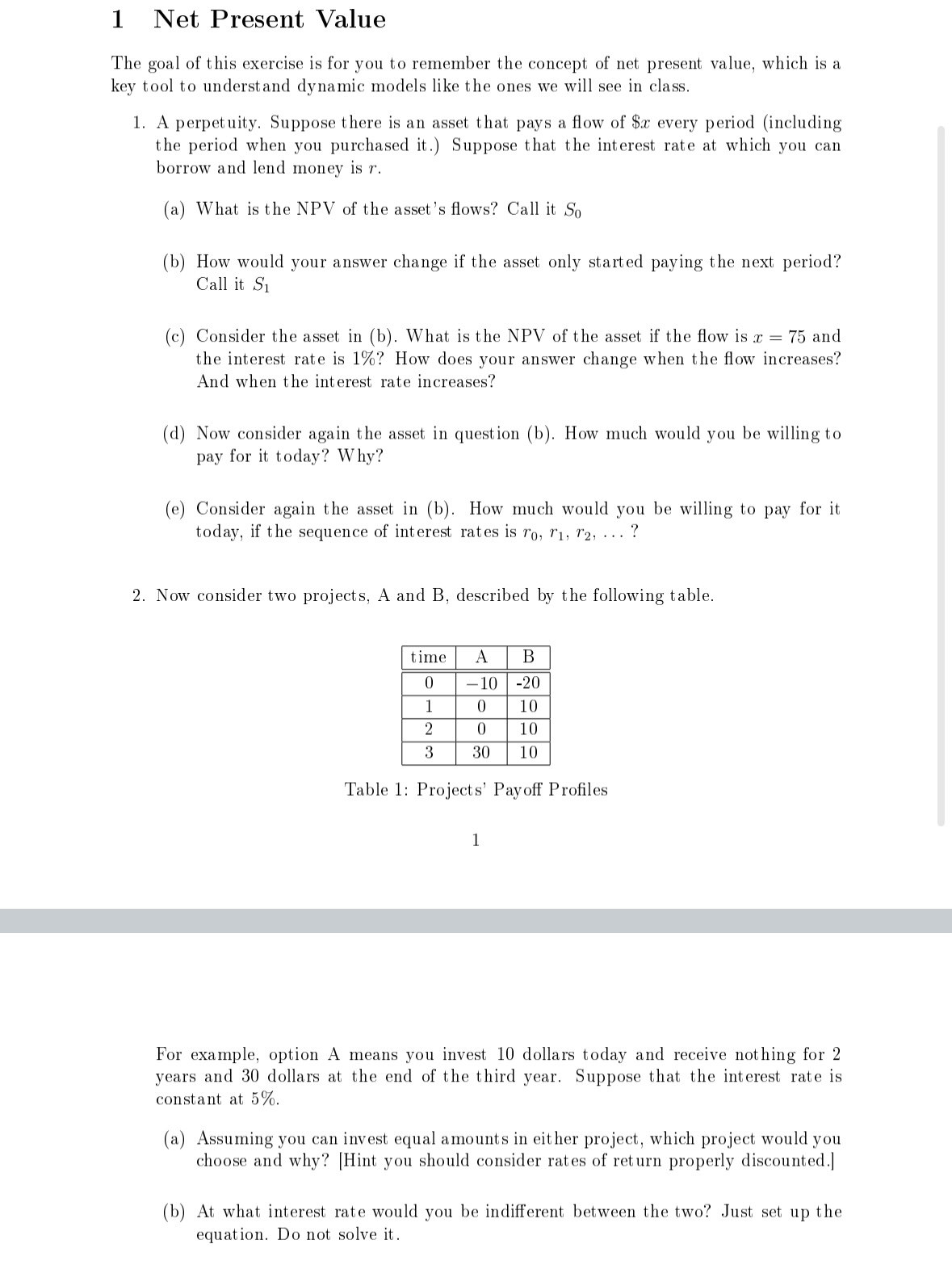

Now consider two projects, A and B described by the following table.

tabletimeAB

Table : Projects' Payoff Profiles

For example, option A means you invest dollars today and receive nothing for years and dollars at the end of the third year. Suppose that the interest rate is constant at

a Assuming you can invest equal amounts in either project, which project would you choose and why? Hint you should consider rates of ret urn properly discounted.

b At what interest rate would you be indifferent between the two? Just set up the equation. Do not solve it

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock