Question: 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle related; that is, as the yield to Paragraph 18. The price of a coupon

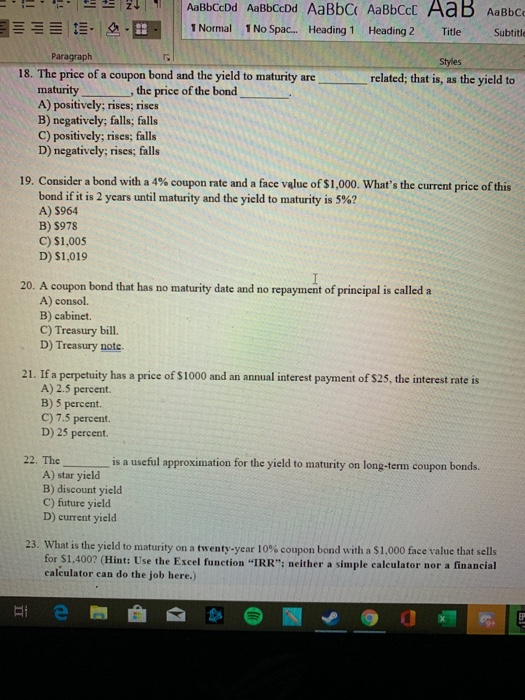

1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle related; that is, as the yield to Paragraph 18. The price of a coupon bond and the yield to maturity are maturity , the price of the bond A) positively; rises, rises B) negatively, falls; falls C) positively; rises, falls D) negatively; rises; falls 19. Consider a bond with a 4% coupon rate and a face value of $1,000. What's the current price of this bond if it is 2 years until maturity and the yield to maturity is 5%? A) 5964 B) 5978 C) $1,005 D) $1,019 20. A coupon bond that has no maturity date and no repayment of principal is called a A) consol. B) cabinet C) Treasury bill. D) Treasury note 21. If a perpetuity has a price of $1000 and an annual interest payment of $25. the interest rate is A) 2.5 percent B) 5 percent C) 7.5 percent D) 25 percent. 22. The is a useful approximation for the yield to maturity on long-term coupon bonds. A) star yield B) discount yield C) future yield D) current yield 23. What is the yield to maturity on a twenty-year 10% coupon bond with a $1.000 face value that sells for $1,4002 (Hint: Use the Excel function "IRR": neither a simple calculator nor a financial calculator can do the job here.) t e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts