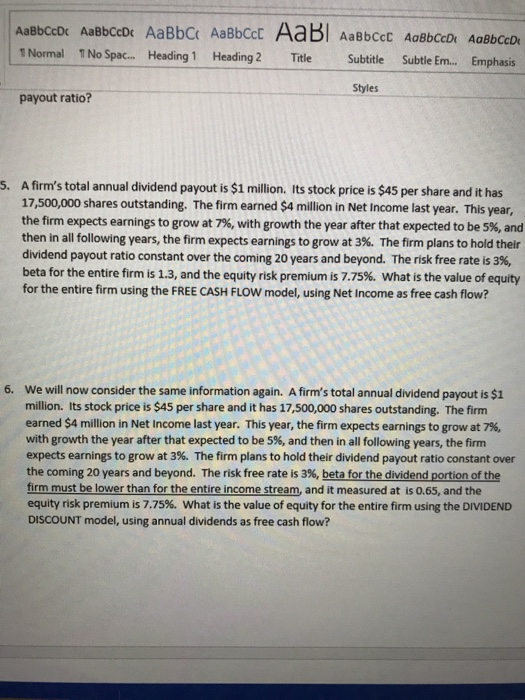

Question: 1 Normal 1No Spac.. Heading 1 Heading2 Title Subtitle Subtle E.. Emphasis Styles payout ratio? A firm's total annual dividend payout is $1 million. Its

1 Normal 1No Spac.. Heading 1 Heading2 Title Subtitle Subtle E.. Emphasis Styles payout ratio? A firm's total annual dividend payout is $1 million. Its stock price is $45 per share and it has 7,500,000 shares outstanding. The firm earned $4 million in Net Income last year. This year, the firm expects earnings to grow at 7%, with growth the year after that expected to be 5%, and then in all following years, the firm expects earnings to grow at 3%. The firm plans to hold their dividend payout ratio constant over the coming 20 years and beyond. The risk free rate is 3%, beta for the entire firm is 1.3, and the equity risk premium is 7.75%, what is the value of equity for the entire firm using the FREE CASH FLOW model, using Net income as free cash flow? 5. We will now consider the same information again. A firm's total annual dividend payout is $1 million. Its stock price is $45 per share and it has 17,500,000 shares outstanding. The firm earned $4 million in Net Income last year. This year, the firm expects earnings to grow at 7%, with growth the year after that expected to be 5%, and then in all following years, the firm expects earnings to grow at 3%. The firm plans to hold their dividend payout ratio constant over the coming 20 years and beyond. The risk free rate is 3%, beta for the dividend portion of the firm must be lower than for the entire income stream, and it measured at is 0.65, and the equity risk premium is 7.75%, what is the value of equity for the entire firm using the DVIDEND DISCOUNT model, using annual dividends as free cash flow? 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts