Question: 1. NOTE: This problem requires present value information. Charter Corp. manufactures office equipment and supplies throughout the US. The company owns property, plant, and equipment

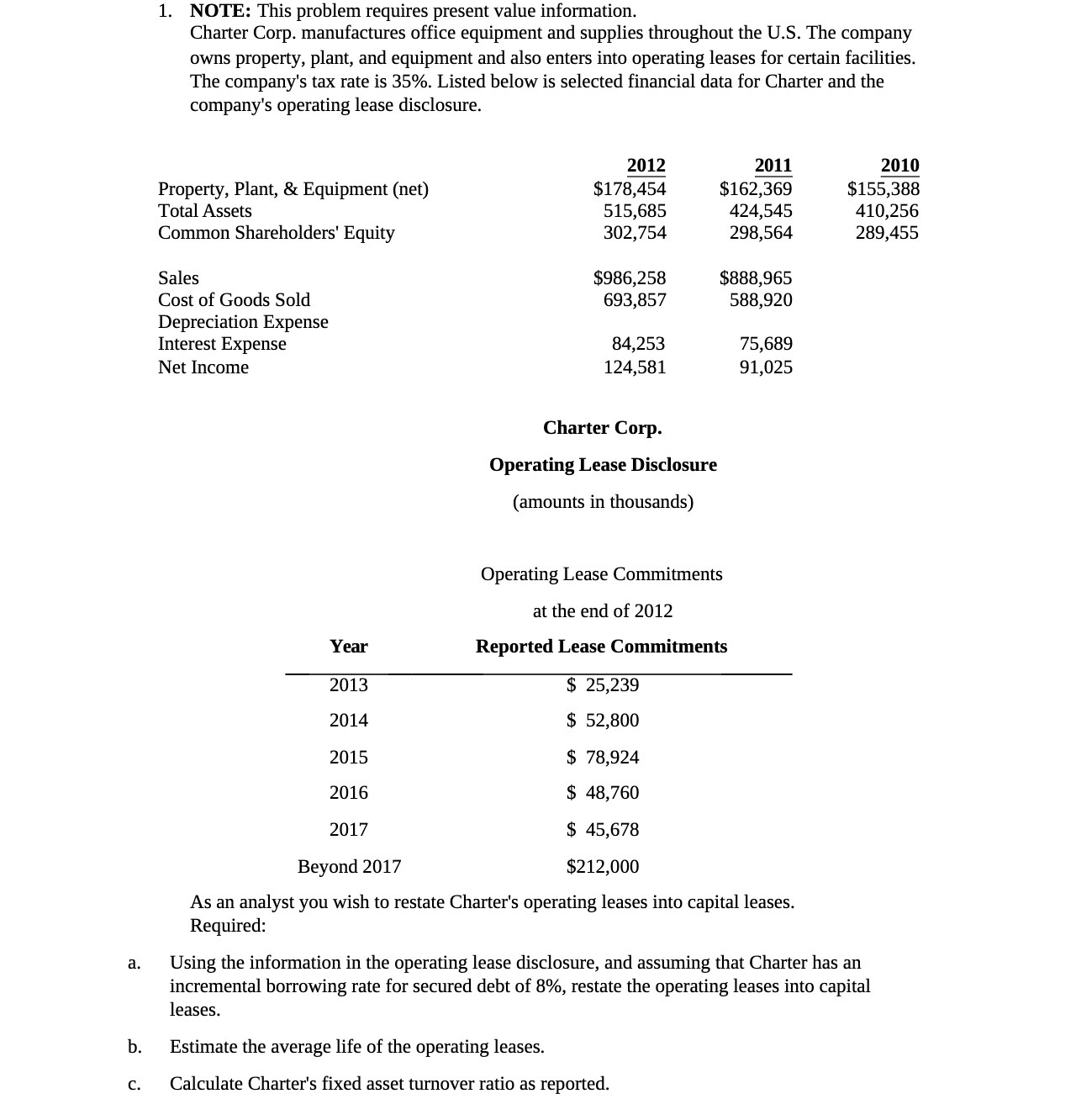

1. NOTE: This problem requires present value information. Charter Corp. manufactures office equipment and supplies throughout the US. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. The company's tax rate is 35%. Listed below is selected financial data for Charter and the company's operating lease disclosure. Property, Plant, 8: Equipment (net) Total Assets Common Shareholders' Equity Sales Cost of Goods Sold Depreciation Expense Interest Expense Net Income Year 2013 2014 2015 2016 2017 Beyond 2017 20 12 2011 $178,454 $162,369 515,685 424,545 302,754 298,564 $9862 58 $8 88,965 693,857 588,920 84,253 75,689 124,581 91,025 Charter Corp. Operating Lease Disclosure (amounts in thousands) Operating Lease Commitments at the end of 2012 Reported Lease Commitments $ 25,239 $ 52,800 $ 78,924 $ 48,760 $ 45,678 $212,000 As an analyst you wish to restate Charter's operating leases into capital leases. Required: 20 10 $155,333 410,256 239,455 Using the information in the operating lease disclosure, and assuming that Charter has an incremental borrowing rate for secured debt of 8%, restate the operating leases into capital leases. Estimate the average life of the operating leases. Calculate Charter's fixed asset turnover ratio as reported

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts