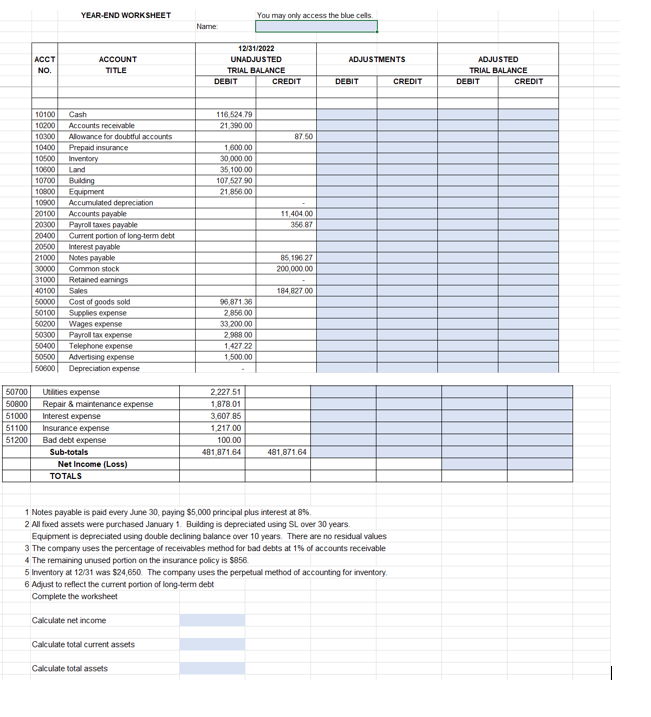

Question: 1 Notes payable is paid every June 3 0 , paying ( $ 5 , 0 0 0 ) principal plus interest

Notes payable is paid every June paying $ principal plus interest at

All foued assets were purchased January Building is depreciated using SL over years.

Equipment is depreciated using double declining balance over years. There are no residual values

The compary uses the percentage of receivables method for bad debts at of accounts receivable

The remaining unused portion on the insurance policy is $

Inventory at was $ The company uses the perpetual method of accounting for inventory.

Adjust to reflect the current portion of longterm debt

Complete the worksheet

Calculate net income

Calculate total current assets

Calculate total assets YEAREND WORKSHEET

You may only access the blue cells.

Name: square

begintabularclccccc

hline & & & & &

hline

endtabular

Notes payable is paid every June paying $ principal plus interest at

All fixed assets were purchased January Building is depreciated using SL over years.

Equipment is depreciated using double declining balance over years. There are no residual values

The company uses the percentage of receivables method for bad debts at of accounts receivable

The remaining unused portion on the insurance policy is $

Inventory at was $ The company uses the perpetual method of accounting for inventory.

Adjust to reflect the current portion of longterm debt

Complete the worksheet

Calculate net income

Calculate total current assets

Calculate total assets

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock