Question: 1- O Decide whether you should itemize your deductions or take the standard deduction in the following case. State how much the better option

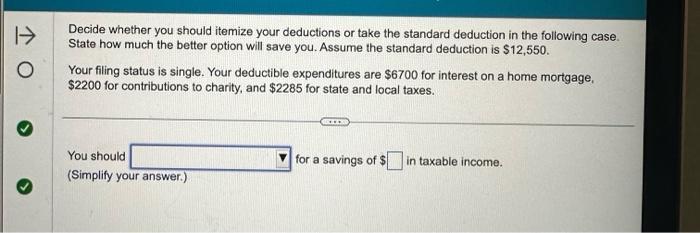

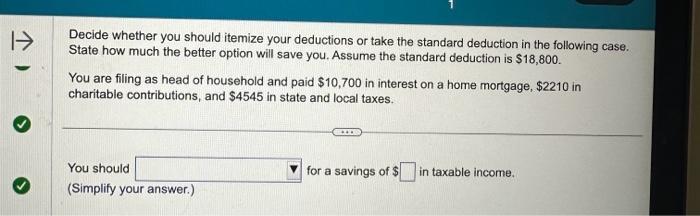

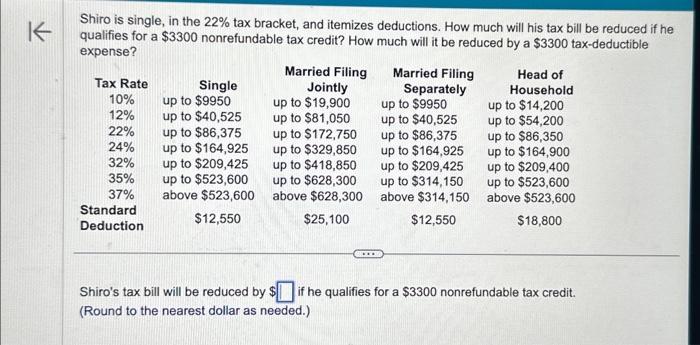

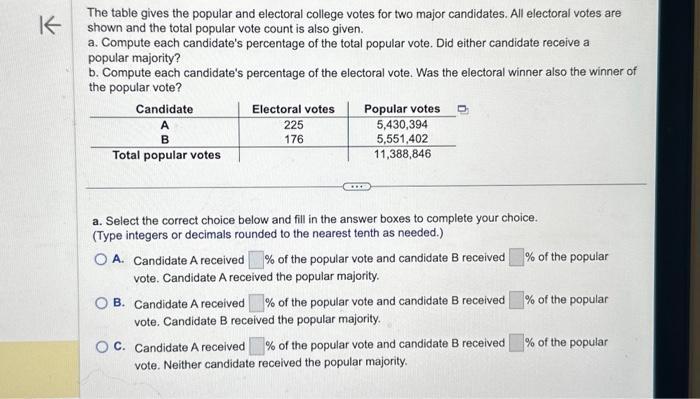

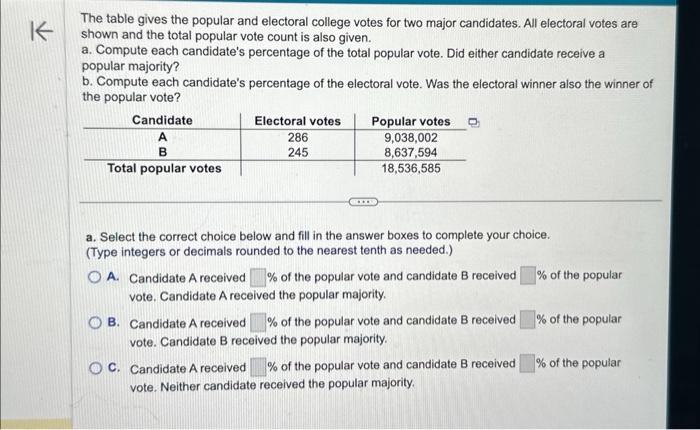

1- O Decide whether you should itemize your deductions or take the standard deduction in the following case. State how much the better option will save you. Assume the standard deduction is $12,550. Your filing status is single. Your deductible expenditures are $6700 for interest on a home mortgage, $2200 for contributions to charity, and $2285 for state and local taxes. You should (Simplify your answer.) GREEN for a savings of $ in taxable income. 1-> Decide whether you should itemize your deductions or take the standard deduction in the following case. State how much the better option will save you. Assume the standard deduction is $18,800. You are filing as head of household and paid $10,700 in interest on a home mortgage, $2210 in charitable contributions, and $4545 in state and local taxes. You should (Simplify your answer.) for a savings of $in taxable income. KK Shiro is single, in the 22% tax bracket, and itemizes deductions. How much will his tax bill be reduced if he qualifies for a $3300 nonrefundable tax credit? How much will it be reduced by a $3300 tax-deductible expense? Tax Rate 10% 12% 22% 24% 32% 35% 37% Standard Deduction Single up to $9950 up to $40,525 up to $86,375 up to $164,925 up to $209,425 up to $523,600 above $523,600 $12,550 Married Filing Jointly up to $19,900 up to $81,050 up to $172,750 up to $329,850 up to $418,850 up to $628,300 above $628,300 $25,100 Married Filing Separately up to $9950 up to $40,525 up to $86,375 up to $164,925 up to $209,425 up to $314,150 above $314,150 $12,550 Head of Household up to $14,200 up to $54,200 up to $86,350 up to $164,900 up to $209,400 up to $523,600 above $523,600 $18,800 Shiro's tax bill will be reduced by $ if he qualifies for a $3300 nonrefundable tax credit. (Round to the nearest dollar as needed.) K The table gives the popular and electoral college votes for two major candidates. All electoral votes are shown and the total popular vote count is also given. a. Compute each candidate's percentage of the total popular vote. Did either candidate receive a popular majority? b. Compute each candidate's percentage of the electoral vote. Was the electoral winner also the winner of the popular vote? Candidate. A B Total popular votes Electoral votes 225 176 Popular votes 5,430,394 5,551,402 11,388,846 a. Select the correct choice below and fill in the answer boxes to complete your choice. (Type integers or decimals rounded to the nearest tenth as needed.) O A. Candidate A received % of the popular vote and candidate B received vote. Candidate A received the popular majority. OB. Candidate A received % of the popular vote and candidate B received vote. Candidate B received the popular majority. OC. Candidate A received % of the popular vote and candidate B received. vote. Neither candidate received the popular majority. % of the popular % of the popular % of the popular K The table gives the popular and electoral college votes for two major candidates. All electoral votes are shown and the total popular vote count is also given. a. Compute each candidate's percentage of the total popular vote. Did either candidate receive a popular majority? b. Compute each candidate's percentage of the electoral vote. Was the electoral winner also the winner of the popular vote? Candidate A B Total popular votes Electoral votes 286 245 Popular votes 9,038,002 8,637,594 18,536,585 a. Select the correct choice below and fill in the answer boxes to complete your choice. (Type integers or decimals rounded to the nearest tenth as needed.) OA. Candidate A received % of the popular vote and candidate B received % of the popular vote. Candidate A received the popular majority. OB. Candidate A received % of the popular vote and candidate B received % of the popular vote. Candidate B received the popular majority. OC. Candidate A received % of the popular vote and candidate B received vote. Neither candidate received the popular majority. % of the popular

Step by Step Solution

There are 3 Steps involved in it

SOLUTION In the first case lets compare itemizing deductions versus taking the standard deduction Standard deduction 12550 Deductible expenditures Interest on home mortgage 6700 Charitable contributio... View full answer

Get step-by-step solutions from verified subject matter experts