Question: 1. Oliver, Patrick & Quincy LLP. is beginning liquidation. It has no cash, total liabilities of P60,000 including = P5,000 loan payable to Patrick, and

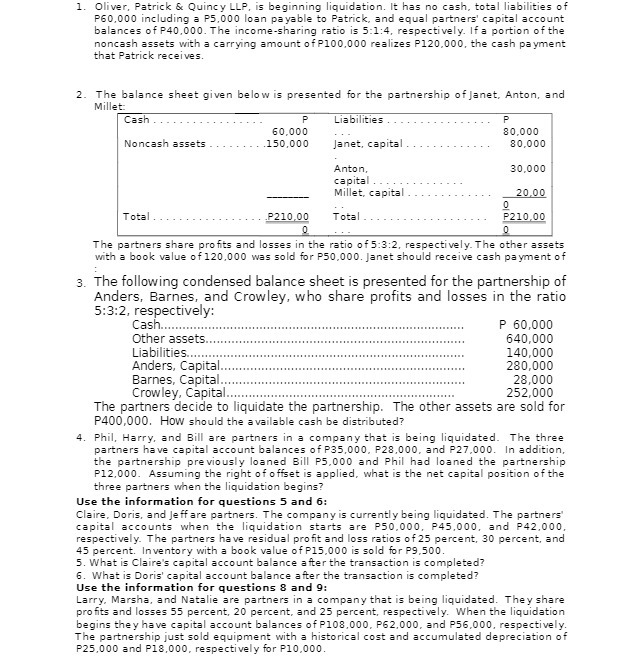

1. Oliver, Patrick & Quincy LLP. is beginning liquidation. It has no cash, total liabilities of P60,000 including = P5,000 loan payable to Patrick, and equal partners' capital account balances of P40,000. The income-sharing ratio is 5:1:4, respectively. If a portion of the noncash assets with a carrying amount of P100,000 realizes P120.000, the cash payment that Patrick receives. 2. The balance sheet given below is presented for the partnership of Janet, Anton, and Millet: Cash . . . Liabilities . 60.000 80,000 Noncash assets .. .150,000 Janet, capital . . . 80,000 Anton, 30.000 Millet, capital 20,00 0 Total . P210,00 Total P210,00 0 The partners share profits and losses in the ratio of 5:3:2, respectively. The other assets with a book value of 120,000 was sold for P50,000. Janet should receive cash payment of 3. The following condensed balance sheet is presented for the partnership of Anders, Barnes, and Crowley, who share profits and losses in the ratio 5:3:2, respectively: Cash......... P 60,000 Other assets..... 640,000 Liabilities.... 140,000 Anders, Capital.... ...... 280,000 Barnes, Capital......... 28,000 Crowley, Capital..... 252,000 The partners decide to liquidate the partnership. The other assets are sold for P400,000. How should the available cash be distributed? 4 . Phil, Harry, and Bill are partners in a company that is being liquidated. The three partners have capital account balances of P35,000. P28,000, and P27.000. In addition, the partnership previously loaned Bill P5,000 and Phil had loaned the partnership P12,000. Assuming the right of offset is applied, what is the net capital position of the three partners when the liquidation begins? Use the information for questions 5 and 6: Claire, Doris, and Jeffare partners. The company is currently being liquidated. The partners capital accounts when the liquidation starts are P50,000, P45,000, and P42,000, respectively. The partners have residual profit and loss ratios of 25 percent, 30 percent, and 45 percent. Inventory with a book value of P15,000 is sold for P9.500. 5. What is Claire's capital account balance after the transaction is completed? 6. What is Doris' capital account balance after the transaction is completed? Use the information for questions 8 and 9: Larry. Marsha, and Natalie are partners in a company that is being liquidated. They share profits and losses 55 percent, 20 percent, and 25 percent, respectively. When the liquidation begins they have capital account balances of P108,000, P62,000, and P56,000, respectively. The partnership just sold equipment with a historical cost and accumulated depreciation of P25,000 and P18,000, respectively for P10,000