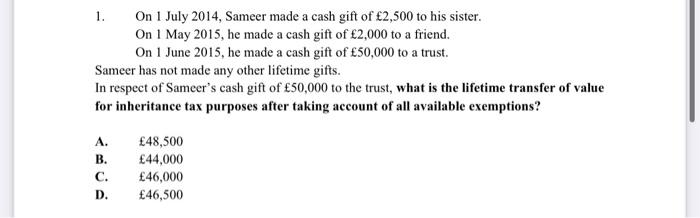

Question: 1. On 1 July 2014, Sameer made a cash gift of 2,500 to his sister. On 1 May 2015, he made a cash gift of

1. On 1 July 2014, Sameer made a cash gift of 2,500 to his sister. On 1 May 2015, he made a cash gift of 2,000 to a friend. On 1 June 2015, he made a cash gift of 50,000 to a trust. Sameer has not made any other lifetime gifts. In respect of Sameer's cash gift of 50,000 to the trust, what is the lifetime transfer of value for inheritance tax purposes after taking account of all available exemptions? A. 48,500 B. 44,000 C. 46,000 D. 46,500

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock