Question: 1. On a FIFO basis, what are the percent changes in the cost per completed unit from one group to the next over the three-month

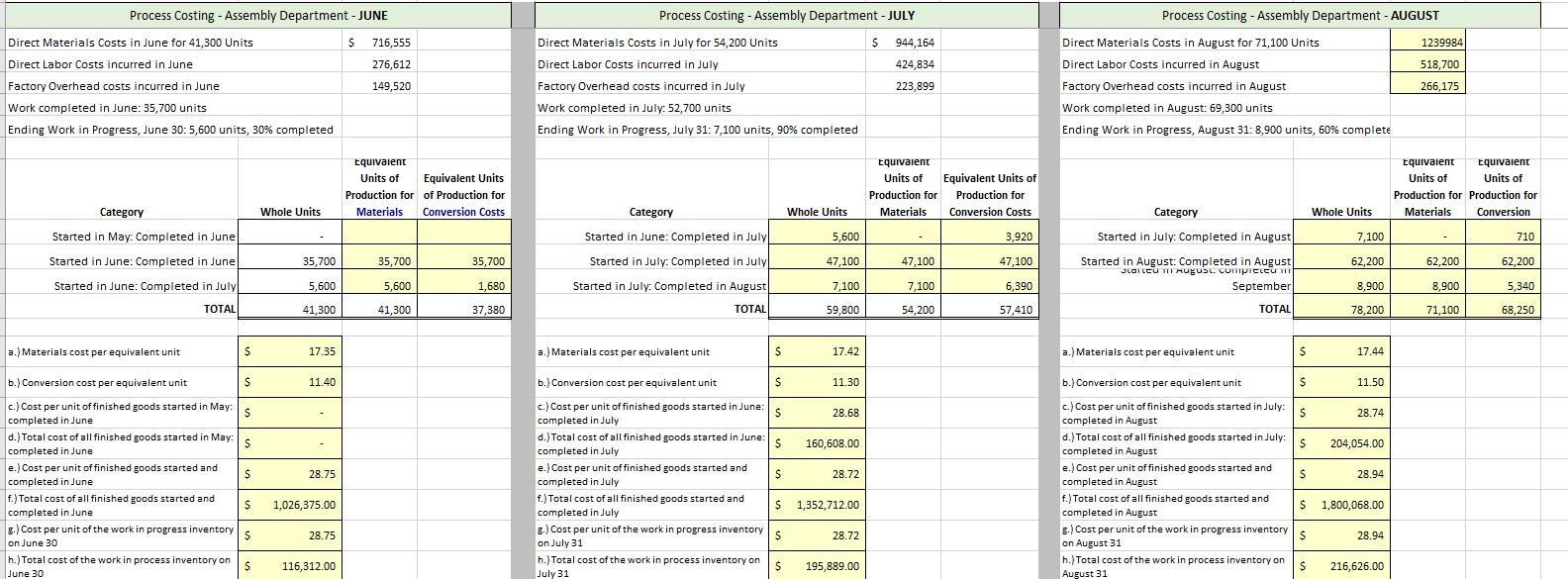

1. On a FIFO basis, what are the percent changes in the cost per completed unit from one group to the next over the three-month period? What may have caused these differences?

heres the information you'll need.

Process Costing - Assembly Department - JUNE $ 716,555 276,612 149,520 Direct Materials Costs in June for 41,300 Units Direct Labor Costs incurred in June Factory Overhead costs incurred in June Work completed in June: 35,700 units Ending Work in Progress, June 30: 5,600 units, 30% completed Category Started in May: Completed in June Started in June: Completed in June Started in June: Completed in July TOTAL a.) Materials cost per equivalent unit b.) Conversion cost per equivalent unit c.) Cost per unit of finished goods started in May: completed in June $ e.) Cost per unit of finished goods started and completed in June $ d.) Total cost of all finished goods started in May: completed in June $ f.) Total cost of all finished goods started and completed in June $ C g.) Cost per unit of the work in progress inventory on June 30 $ $ $ h.) Total cost of the work in process inventory on June 30 $ Whole Units 35,700 5,600 41,300 17.35 11.40 28.75 1,026,375.00 28.75 116,312.00 Equivalent Units Equivalent Units of Production for of Production for Materials Conversion Costs 35,700 5,600 41,300 35,700 1,680 37,380 Process Costing - Assembly Department - JULY $ Direct Materials Costs in July for 54,200 Units Direct Labor Costs incurred in July Factory Overhead costs incurred in July Work completed in July: 52,700 units Ending Work in Progress, July 31: 7,100 units, 90% completed Category Started in June: Completed in July Started in July: Completed in July Started in July: Completed in August TOTAL a.) Materials cost per equivalent unit b.) Conversion cost per equivalent unit c.) Cost per unit of finished goods started in June: completed in July $ e.) Cost per unit of finished goods started and completed in July $ d.) Total cost of all finished goods started in June: completed in July $ f.) Total cost of all finished goods started and completed in July $ g.) Cost per unit of the work in progress inventory on July 31 $ Whole Units h.) Total cost of the work in process inventory on July 31 $ 5,600 47,100 7,100 59,800 17.42 11.30 28.68 160,608.00 $ 1,352,712.00 28.72 28.72 195,889.00 944,164 424,834 223,899 Equivalent Units of Production for Materials 47,100 7,100 54,200 Equivalent Units of Production for Conversion Costs 3.920 47,100 6,390 57,410 Process Costing - Assembly Department - AUGUST Direct Materials Costs in August for 71,100 Units Direct Labor Costs incurred in August Factory Overhead costs incurred in August Work completed in August: 69,300 units Ending Work in Progress, August 31: 8,900 units, 60% complete Category Started in July: Completed in August Started in August: Completed in August Lareu i August. Compreleu i September a.) Materials cost per equivalent unit TOTAL b.) Conversion cost per equivalent unit c.) Cost per unit of finished goods started in July: completed in August $ d.) Total cost of all finished goods started in July: completed in August e.) Cost per unit of finished goods started and completed in August f.) Total cost of all finished goods started and completed in August g.) Cost per unit of the work in progress inventory on August 31 $ h.) Total cost of the work in process inventory on August 31 $ $ $ Whole Units $ 7,100 62,200 8,900 78,200 17.44 11.50 28.74 $ $ 1,800,068.00 204,054.00 28.94 28.94 216,626.00 1239984 518,700 266,175 Equivalent Equivalent Units of Units of Production for Production for Materials Conversion 62,200 8,900 71,100 710 62,200 5,340 68,250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts