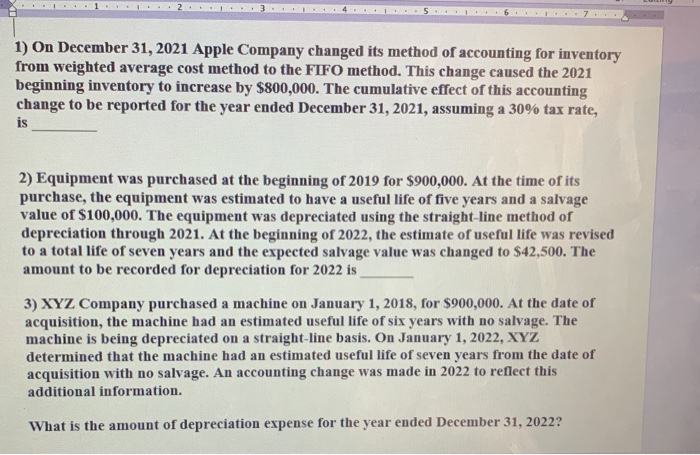

Question: 1) On December 31, 2021 Apple Company changed its method of accounting for inventory from weighted average cost method to the FIFO method. This change

1) On December 31, 2021 Apple Company changed its method of accounting for inventory from weighted average cost method to the FIFO method. This change caused the 2021 beginning inventory to increase by $800,000. The cumulative effect of this accounting change to be reported for the year ended December 31, 2021, assuming a 30% tax rate, is 2) Equipment was purchased at the beginning of 2019 for $900,000. At the time of its purchase, the equipment was estimated to have a useful life of five years and a salvage value of $100,000. The equipment was depreciated using the straight-line method of depreciation through 2021. At the beginning of 2022, the estimate of useful life was revised to a total life of seven years and the expected salvage value was changed to $42,500. The amount to be recorded for depreciation for 2022 is 3) XYZ Company purchased a machine on January 1, 2018, for $900,000. At the date of acquisition, the machine had an estimated useful life of six years with no salvage. The machine is being depreciated on a straight-line basis. On January 1, 2022, XYZ determined that the machine had an estimated useful life of seven years from the date of acquisition with no salvage. An accounting change was made in 2022 to reflect this additional information. What is the amount of depreciation expense for the year ended December 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts