Question: 1 . On February 5 , 2 0 2 3 , Fox Industries Inc. purchased land for the purpose of constructing a 1 0 marks

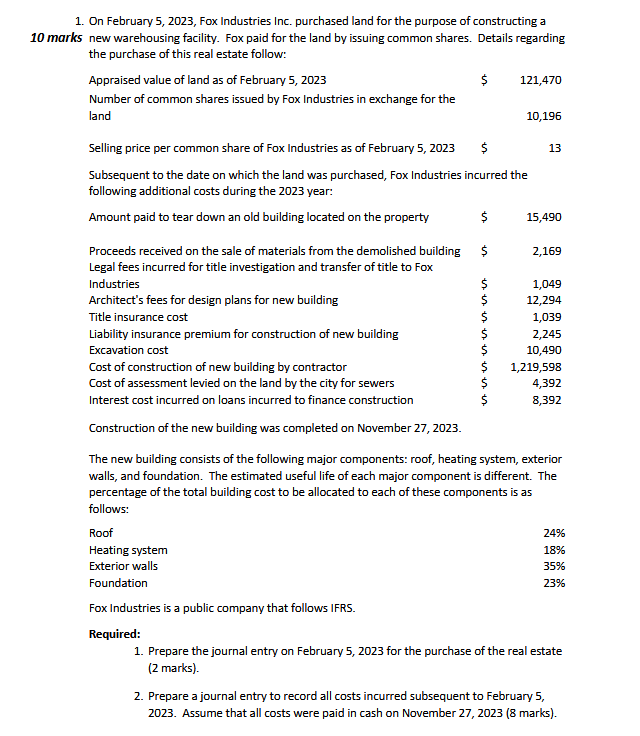

On February Fox Industries Inc. purchased land for the purpose of constructing a marks new warehousing facility. Fox paid for the land by issuing common shares. Details regarding the purchase of this real estate follow: Appraised value of land as of February Number of common shares issued by Fox Industries in exchange for the land Selling price per common share of Fox Industries as of February $ Subsequent to the date on which the land was purchased, Fox Industries incurred the following additional costs during the year: Construction of the new building was completed on November The new building consists of the following major components: roof, heating system, exterior walls, and foundation. The estimated useful life of each major component is different. The percentage of the total building cost to be allocated to each of these components is as follows: Fox Industries is a public company that follows IFRS. Required: Prepare the journal entry on February for the purchase of the real estate marks Prepare a journal entry to record all costs incurred subsequent to February Assume that all costs were paid in cash on November marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock