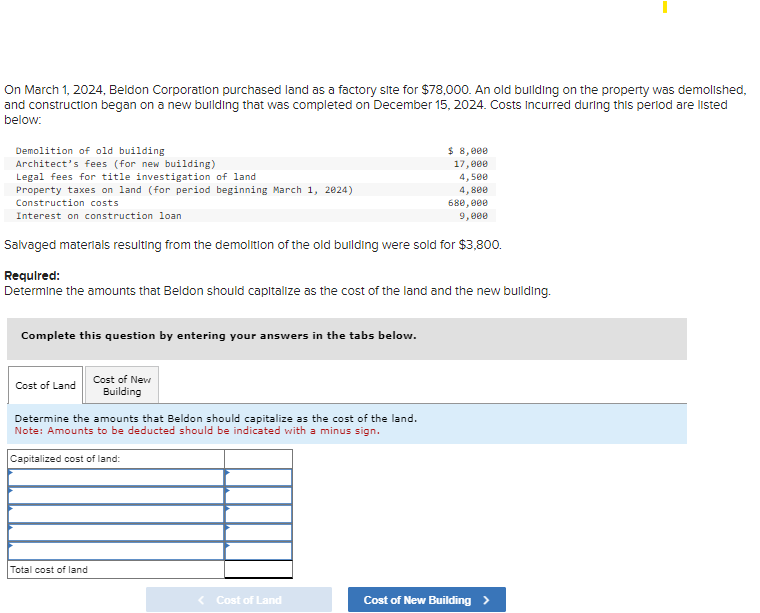

Question: 1 . On March 1 , 2 0 2 4 , Beldon Corporation purchased land as a factory site for $ 7 8 , 0

On March Beldon Corporation purchased land as a factory site for $ An old bullding on the property was demolished,

and construction began on a new bullding that was completed on December Costs Incurred during this perlod are IIsted

below:

Demolition of old building

Architect's fees for new building

Legal fees for title investigation of land

Property taxes on land for period beginning March

Construction costs

Interest on construction loan

Salvaged materlals resulting from the demolition of the old bullding were sold for $

Requlred:

Determine the amounts that Beldon should capltallze as the cost of the land and the new bullding.

Complete this question by entering your answers in the tabs below.

Determine the amounts that Beldon should capitalize as the cost of the land.

Note: Amounts to be deducted should be indicated with a minus sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock