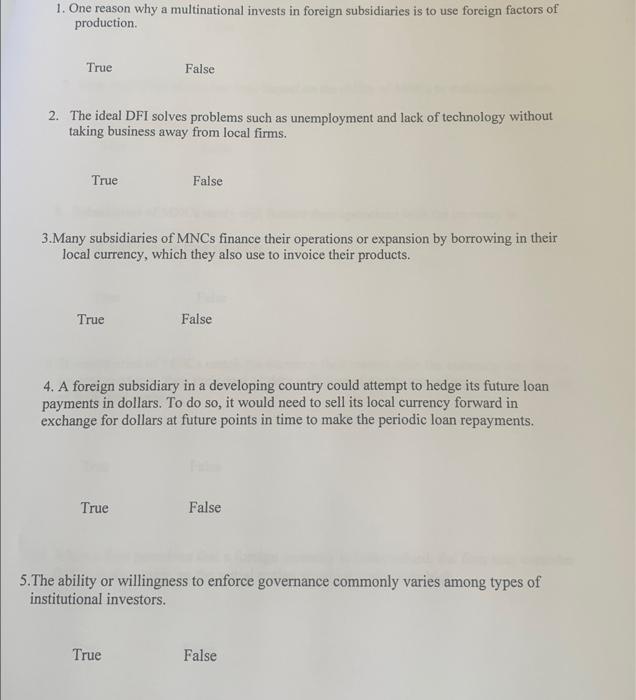

Question: 1. One reason why a multinational invests in foreign subsidiaries is to use foreign factors of production. True False 2. The ideal DFI solves problems

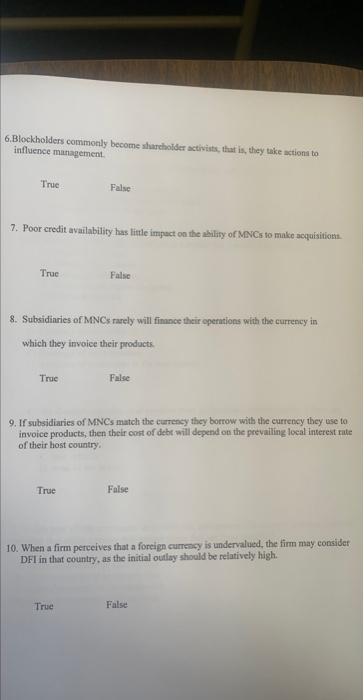

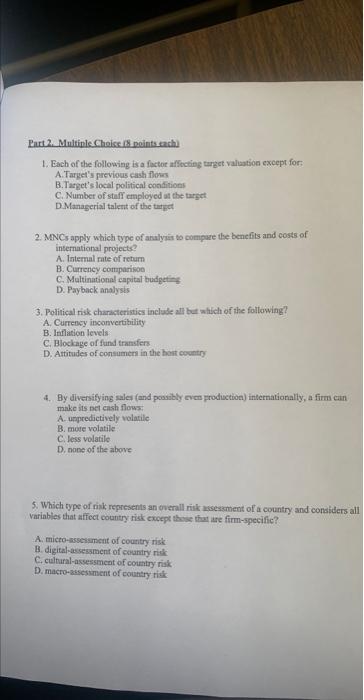

1. One reason why a multinational invests in foreign subsidiaries is to use foreign factors of production. True False 2. The ideal DFI solves problems such as unemployment and lack of technology without taking business away from local firms. True False 3.Many subsidiaries of MNCs finance their operations or expansion by borrowing in their local currency, which they also use to invoice their products. True False 4. A foreign subsidiary in a developing country could attempt to hedge its future loan payments in dollars. To do so, it would need to sell its local currency forward in exchange for dollars at future points in time to make the periodic loan repayments. True False 5. The ability or willingness to enforce governance commonly varies among types of institutional investors. True False 6. Biockholders commonly become sharchoider activists, that is, they tuke actiona to influence mantagement. True False 7. Poor credit availability has little impact on ithe ability of MNCs to make acquisitioni. True False 8. Subsidinries of MNCs rarely will fimnce their cpernions with the currency in which they invoice their products. False 9. If subsidiaries of MNCs match the eurrency they borrow with the eurrency they use to invoice products, then their cost of debe will depend on the prevaling local interest rute of their host country. False 10. When a firm perceives that a foreign curreny is undervalued, the firm may consider DFI in that country, as the initial oullay should be refatively high. 1. Each of the following is a factor affictiog turget valuation except for: A. Target'y previous cash flows B. Tarpet's local political confitions C. Number of staff employed at the target DManagerial talent of the turget 2. MNCs apply which type of analymir to compure the benefits and costs of international projects? A. Iatemal nate of return B. Curreney comparisoo C. Multinational capital budpeting D. Payback analysis 3. Political risk characteristics include atl bet which of the following? A. Currency inconvertibility B. Inflation levels C. Blockage of fund transfers D. Attitudes of consumen in the bert country 4. By divesifying sales (and poosibly cven production) internationally, a firm cin make its net cash flows: A. uppredictively volatile B. more volatile C. less volatile D. none of the above 5. Which type of rivk represents an overall rik usessment of a country and considers all variables that affect country tisk except those that are firm-specific? A. micto-issesement of country risk B. digitah-assessment of cenantry rikk C. cultural-assessmeat of country rikk D. macro-absessment of county risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts