Question: 1) Option A 2) Option B 3) Option C 4) Option D 5) Option E Required information The Keaton, Lewis, and Meador partnership had the

1) Option A

2) Option B

3) Option C

4) Option D

5) Option E

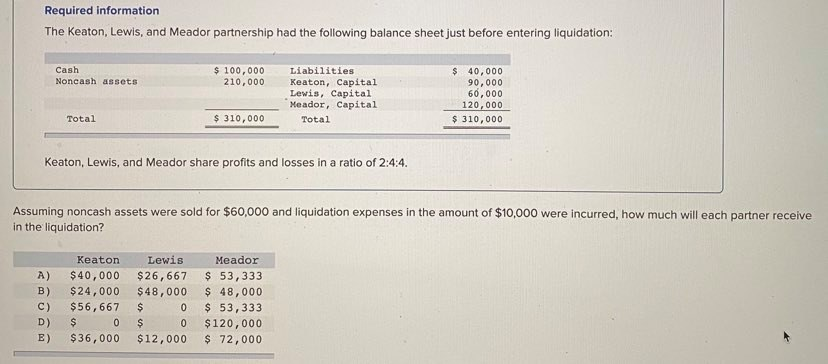

Required information The Keaton, Lewis, and Meador partnership had the following balance sheet just before entering liquidation: Cash Noncash assets $ 100,000 210,000 Liabilities Keaton, Capital Lewis, Capital Meador, Capital Total $ 40,000 90,000 60,000 120,000 $ 310,000 Total $ 310,000 Keaton, Lewis, and Meador share profits and losses in a ratio of 2:4:4. Assuming noncash assets were sold for $60,000 and liquidation expenses in the amount of $10,000 were incurred, how much will each partner receive in the liquidation? A) B) c) D) B) Keaton $40,000 $ 24,000 $56,667 $ 0 $36,000 Lewis $26,667 $ 48,000 $ 0 $ 0 $12,000 Meador $ 53,333 $ 48,000 $ 53,333 $120,000 $ 72,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts