Question: 1. Option basics The Chicago Board Options Exchange (CBOE) is one of the world's largest options exchanges. CBOE and other options exchanges trade contracts that

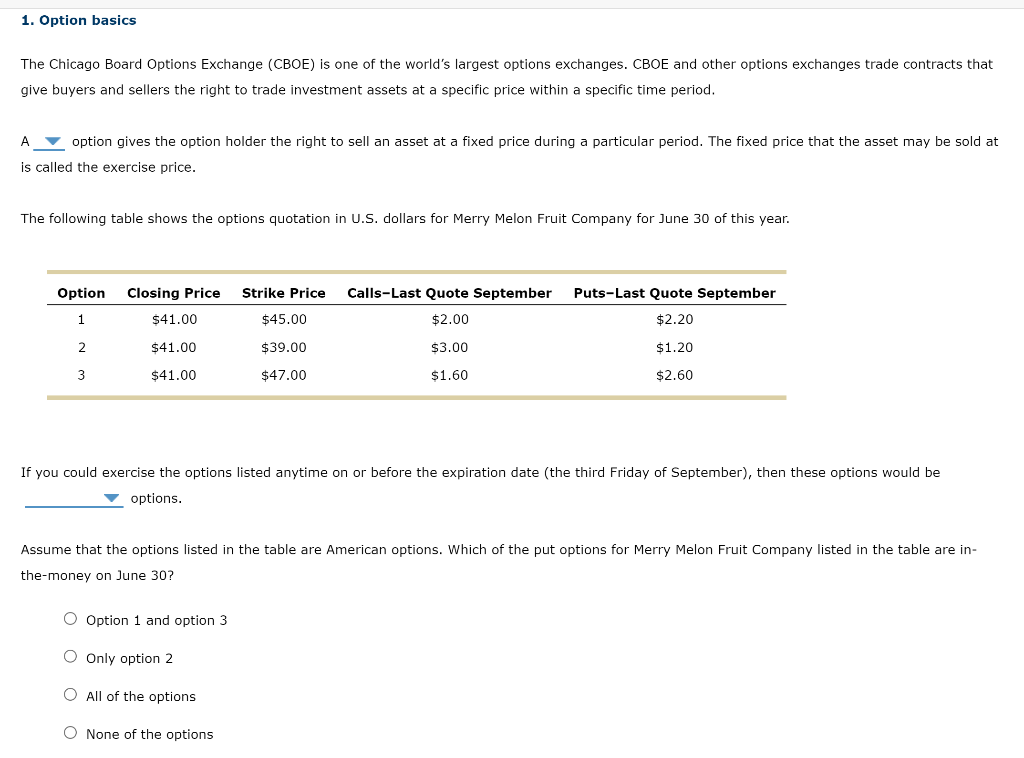

1. Option basics The Chicago Board Options Exchange (CBOE) is one of the world's largest options exchanges. CBOE and other options exchanges trade contracts that give buyers and sellers the right to trade investment assets at a specific price within a specific time period. A option gives the option holder the right to sell an asset at a fixed price during a particular period. The fixed price that the asset may be sold at is called the exercise price. The following table shows the options quotation in U.S. dollars for Merry Melon Fruit Company for June 30 of this year. Option Closing Price Strike Price Calls-Last Quote September Puts-Last Quote September 1 $41.00 $45.00 $2.00 2 $41.00 $39.00 $3.00 $2.20 $1.20 $2.60 3 $41.00 $47.00 $1.60 If you could exercise the options listed anytime on or before the expiration date (the third Friday of September), then these options would be options. Assume that the options listed in the table are American options. Which of the put options for Merry Melon Fruit Company listed in the table are in- the-money on June 30? O Option 1 and option 3 O Only option 2 O All of the options O None of the options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts