Question: 1. Option Hedging Strategies - 15 Points Using the daily stock price data provided on the file FE_Data.xlsx, consider the Black-Scholes model with B0=1, and

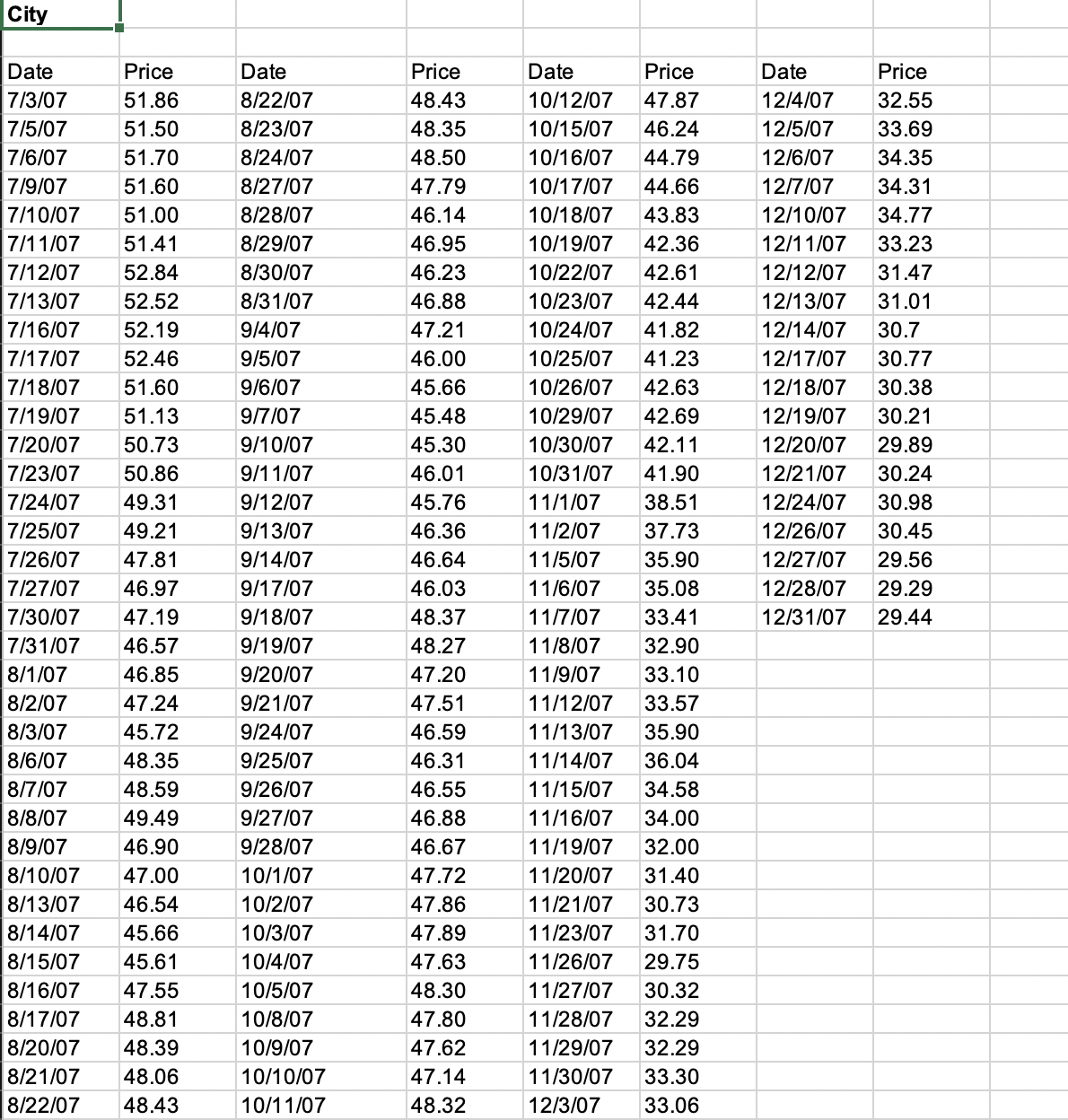

1. Option Hedging Strategies - 15 Points Using the daily stock price data provided on the file FE_Data.xlsx, consider the Black-Scholes model with B0=1, and a market-maker with no securities in its balance sheet just sold N=50,000 units of at-the-money (K=S0=51.86) call option on the Citibank (C) stock on 7/3/2007 with maturity 12/31/2007 (6 months). Interest rate is assumed to be constant at r=5% and the constant volatility of the stock is estimated to be =39%. (a) Consider the naked position strategy by simply investing the proceeds of the sale in the bond, provide a graph of the daily net equity value VNE for the next 4 months. (b) Consider the covered position strategy of buying the same amount of stock shares as the sold call option, provide a graph of the daily net equity value VNE for the next 4 months. (c) Consider the delta hedging strategy, provide a graph of the required daily cash inflow/outflow to keep the hedge for the next 4 months. \{For this part, you may find the delta hedging example considered on the file FE _Main. xlsx helpful. } (d) Consider the delta and gamma hedging strategy by using a second call option written on the same stock with the same maturity but with the strike price K2=0.9K=0.9S0, provide a graph of the required daily cash inflow/outflow to keep the hedge for the next 4 months. City

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts