Question: 1 Pace Leisurewear Ltd (1) This is absolutely typical of British banks. As soon as you have any success they want to pull the plug

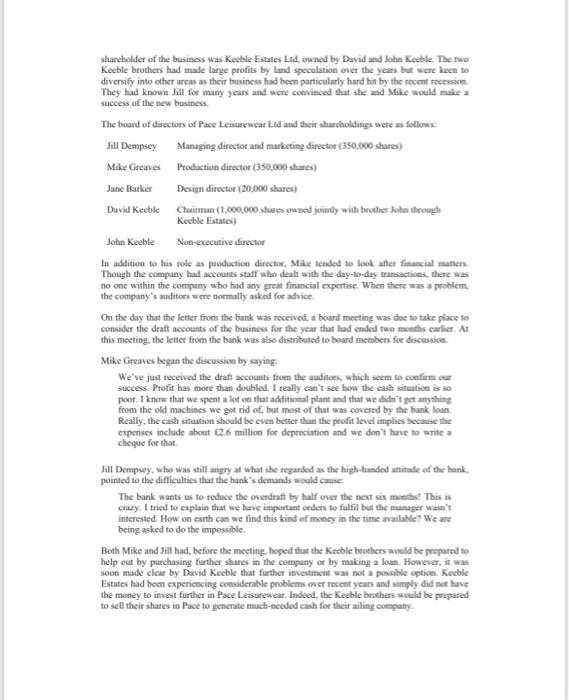

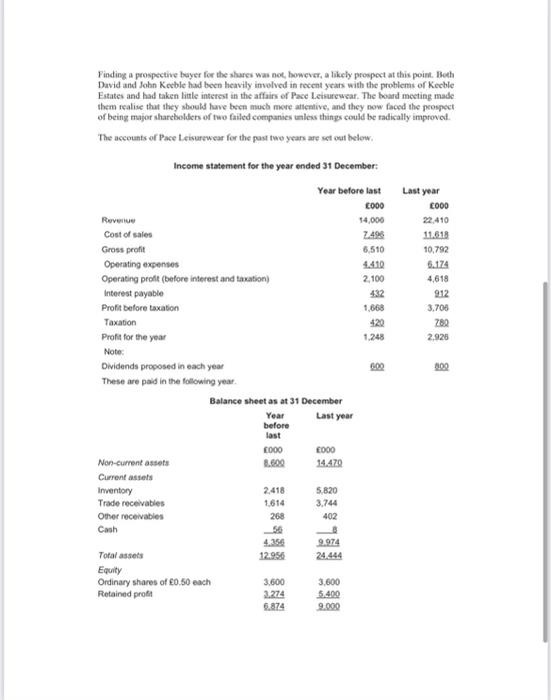

1 Pace Leisurewear Ltd (1) This is absolutely typical of British banks. As soon as you have any success they want to pull the plug and stop you trading. Jill Dempsey was very my. She is the managing director of Pace Leisurewear Ltd and had just received a letter from the company's bank requiring a significant reduction in the overdraft. This is ridiculous agreed Mike Greaves, the production director. "Last year we had a cracking year and it looks set to continue. We had a big order in from Arena just this morning. If we can't keep up the overdraft we won't be able to fulfil that order. Arena was one of several national chains of casual and sportswear stones that was placing substantial orders with Pace, usually to be sold under the Pace label but in some cases under the stores own-brand label. Pace Leisurewear Lid was started by im Dempsey and Mike Greaves five years ago. The business is a designer and manufacturer of casual and leisure clothes aimed particularly at the younger, higher-income market. Before starting the company, both had been employed as senior managers with Verani plc, a large UK clothes manufacturer. They decided to form Pace Leisurewear after their ideas for developing a new range of clothes for younger people had been rejected by Verani. Although their formet employer liked the ideas proposed, it was Testructuring its operations after three consecutive years of losses and had decided to focus on certain core brands aimed at meeting the needs of older people requiring smart day and occasion wear. The proposals by Jill and Mike did not, therefore, fit with the strategies that Verani had just begun to implement From the outset, Jill and Mike decided that Pace Leistencat would be a design and marketing led business. Both felt that many of the problems experienced by Veran could be traced to weaknesses in these areas and they were determined that this would not occur in their newly formed business. Much of the forward planning was concerned with integrating the product design and development with the sales and marketing operations of the business. The new company had taken a lot of trouble and spent a lot of money on employing a young and talented design team, led by Jane Barker who had been employed previously as a chief designer for a leading sportswear brand. The range of clothes designed by Jane and her team was greeted with enthusiasm by the major buyers, and this was converted into firm orders by the marketing team led by Jill Dempsey. The order book began to grow and for the new season orders had reached their highest level over Pace Leisurewear began trading during a period of recession when people did not have a great deal of money to spend on clothes. However, sales started to increase significantly as the economy began to come slowly out of recession and as export markets in France and Switzerland were opened. Bill and Mike were both surprised and delighted by the speed with which the sales of the business had grown in recent years and by the growing base of regular customers. The order just received from Arena was seen as particularly important. If Arena became a regular customer, the sales of the company were likely to crease rapidly over the next few years and would establish Pace Leisureweat as a major player in the market ill and Mike had both invested their life savings in the business and had taken out large mortgages on their respective houses to help finance the new company. However, this provided only a relatively small amount of the total ordinary share capital needed. In order to raise the remaining share capital, friends, family and business contacts were approached. The largest shareholder of the business was Keeble Estates Lid owned by David and John Keeble. The two Keeble brothers had made large profits by land speculation over the years but were keen to diversify into other areas as their business had been particularly hard hit by the recent recession They had known Jill for many years and were convinced that she and Mike would make a success of the new business The board of directors of Pace Leisurewear Lod and their shacholdings were as follows Jill Dempsey Managing director and marketing director (350,000 shares) Mike Greaves Production director (350,000 shares) Jane Barker Design director (20,000 shares) David Keeble Chuurman (1,000,000 shares and jointly with brother Jobetrough Keeble Estates) John Keeble Non-executive director In addition to his role as production director, Mike tended to look after financial matters Though the company had accounts staff who dealt with the day-to-day transactions, there was no one within the company who had any great financial expertise. When there was a problem, the company's auditors were normally asked for advice On the day that the letter from the bank was received, a board meeting was due to take place to consider the draft accounts of the business for the year that had ended two months earlier. At this meeting, the letter from the bank was also distributed to board members for discussie. Mike Greaves began the discussion by saying We've just received the draft accounts from the auditors, which seem to confirma success. Profit has more than doubled. I teally can't see how the cash cation is so poor. I know that we spent a lot on that additional plant and that we didn't get anything from the old machines we get rid of, but most of that was covered by the bank loan Really, the cash situation should be even better than the profit level implies because the expenses include about 12.6 million for depreciation and we don't have to write a cheque for that Jill Dempsey, who was still angry at what she regarded as the high-handed attitude of the bank pointed to the difficulties that the e bank's demands would cause The bank wants us to reduce the overdraft by half over the next six months This is crazy. I tried to explain that we have important orders to fulfil but the manager wasn't interested. How on earth can we find this kind of money in the time available? We are being asked to do the impossible Both Mike and Jill had, before the meeting, hoped that the Keeble brothers would be prepared to help out by purchasing further shares in the company or by making a loan. However, it was soon made clear by David Keeble that further investment was not a possible option. Keeble Estates had been experiencing considerable problems over recent years and simply did not have the money to invest further in Pace Leisurewear. Indeed, the Keeble brothers would be prepared to sell their shares in Pace to generate much-needed cash for their ailing company Finding a prospective bayer for the shares was not, however, a likely prospect at this point. Both David and John Keeble had been heavily involved in recent years with the problems of Keeble Estates and had taken little interest in the affairs of Pace Leisurewear. The board meeting made them realise that they should have been much more attentive, and they now faced the prospect of being major shareholders of two failed companies unless things could be radically improved The accounts of Pace Leisurewear for the past two years are set out below. Last year 22.410 11.610 10.792 6.174 4,618 912 3.700 780 2.926 000 Income statement for the year ended 31 December: Year before last Reverie 14,000 Cost of sales 2498 Gross profit 6,510 Operating expenses 4.410 Operating profit (before interest and taxation) 2,100 Interest payable 432 Profit before taxation 1.668 Taxation 420 Profit for the year 1.248 Note: Dividends proposed in each year 600 These are paid in the following year Balance sheet as at 31 December Year Last year before last 000 E000 Non-current assets 8.600 14.470 Current assets Inventory 2.418 5.820 Trade receivables 1614 3.744 Other receivables 268 402 Cash 56 4.356 9.974 Total assets 12.956 24.444 Equity Ordinary shares of 0.50 each 3.600 3.600 Retained profit 3.274 5.400 6,874 9.000 Non-current liabilities Loan notes 3.600 Current liabilities Trade payables 1214 2.612 Other payables (inc taxation) 1.268 1.982 Bank overdraft 4250 2.482 8.844 Total equity and liabilities 12.956 24.444 The board of directors was not able to agree on a way of dealing with the financial problem faced by the company, Jill believed that their best hope was to continue to wrangle with the bank over its demands. She felt that there was still a chance that the bank could be persuaded to change its mind once the draft accounts for last year were made available and once the bank was informed of the implications for the company of paying off such a large part of the overdraft in such a short period of time. Mike and Jane, on the other hand, were not optimistic about the prospects of changing the bank's position. The company had breached its overdraft limit several occasions over the past few years and they knew that the patience of the bank was now wearing thin The directors believed that the only real solution was to look for someone who was prepared to make a significant investment in the business. They felt that only a large injection of new funds could keep the business on track. Like Jill the other board members believed that the draft accounts demonstrated the success of the business over recent years and that this evidence would make the business attractive to a potential investor. The Keeble brothers rejected both of these views as being impractical in addition, they were against the idea of introducing another major shareholder to the company as this was likely to dilute their influence over the future direction of the business. The brothers believed that drastic and immediate action was required by the board, although they were not sure what form of action should be taken After several hours of discussion, it was clear that the financial issue was not going to be resolved at the meeting. Instead, it was agreed that expertise from outside the company should be sought to help the company find a feasible solution to the problem. The board decided to approach Drake Management Consultants, which specialises in helping businesses with financial problems, and to ask the firm to produce a plan of action for the board's consideration ill agreed to contact the firm of consultants on behalf of the board and to agree to the terms of reference for the work required. She was, however, apprehensive about what the proposed plan of action would contain Immediately after the board meeting se discussed her concerns with Mike. She said, "It seems we have to pay a penalty for our success only hope this penalty won't involve undoing all our good work over the years Required: Assume that you are a member of Drake Management Consultants. Prepare a report for the board of directors of Pace Leisurewear Lad that analyses the problems faced by the company and that sets out a detailed plan of action for dealing with its financing problem 1 Pace Leisurewear Ltd (1) This is absolutely typical of British banks. As soon as you have any success they want to pull the plug and stop you trading. Jill Dempsey was very my. She is the managing director of Pace Leisurewear Ltd and had just received a letter from the company's bank requiring a significant reduction in the overdraft. This is ridiculous agreed Mike Greaves, the production director. "Last year we had a cracking year and it looks set to continue. We had a big order in from Arena just this morning. If we can't keep up the overdraft we won't be able to fulfil that order. Arena was one of several national chains of casual and sportswear stones that was placing substantial orders with Pace, usually to be sold under the Pace label but in some cases under the stores own-brand label. Pace Leisurewear Lid was started by im Dempsey and Mike Greaves five years ago. The business is a designer and manufacturer of casual and leisure clothes aimed particularly at the younger, higher-income market. Before starting the company, both had been employed as senior managers with Verani plc, a large UK clothes manufacturer. They decided to form Pace Leisurewear after their ideas for developing a new range of clothes for younger people had been rejected by Verani. Although their formet employer liked the ideas proposed, it was Testructuring its operations after three consecutive years of losses and had decided to focus on certain core brands aimed at meeting the needs of older people requiring smart day and occasion wear. The proposals by Jill and Mike did not, therefore, fit with the strategies that Verani had just begun to implement From the outset, Jill and Mike decided that Pace Leistencat would be a design and marketing led business. Both felt that many of the problems experienced by Veran could be traced to weaknesses in these areas and they were determined that this would not occur in their newly formed business. Much of the forward planning was concerned with integrating the product design and development with the sales and marketing operations of the business. The new company had taken a lot of trouble and spent a lot of money on employing a young and talented design team, led by Jane Barker who had been employed previously as a chief designer for a leading sportswear brand. The range of clothes designed by Jane and her team was greeted with enthusiasm by the major buyers, and this was converted into firm orders by the marketing team led by Jill Dempsey. The order book began to grow and for the new season orders had reached their highest level over Pace Leisurewear began trading during a period of recession when people did not have a great deal of money to spend on clothes. However, sales started to increase significantly as the economy began to come slowly out of recession and as export markets in France and Switzerland were opened. Bill and Mike were both surprised and delighted by the speed with which the sales of the business had grown in recent years and by the growing base of regular customers. The order just received from Arena was seen as particularly important. If Arena became a regular customer, the sales of the company were likely to crease rapidly over the next few years and would establish Pace Leisureweat as a major player in the market ill and Mike had both invested their life savings in the business and had taken out large mortgages on their respective houses to help finance the new company. However, this provided only a relatively small amount of the total ordinary share capital needed. In order to raise the remaining share capital, friends, family and business contacts were approached. The largest shareholder of the business was Keeble Estates Lid owned by David and John Keeble. The two Keeble brothers had made large profits by land speculation over the years but were keen to diversify into other areas as their business had been particularly hard hit by the recent recession They had known Jill for many years and were convinced that she and Mike would make a success of the new business The board of directors of Pace Leisurewear Lod and their shacholdings were as follows Jill Dempsey Managing director and marketing director (350,000 shares) Mike Greaves Production director (350,000 shares) Jane Barker Design director (20,000 shares) David Keeble Chuurman (1,000,000 shares and jointly with brother Jobetrough Keeble Estates) John Keeble Non-executive director In addition to his role as production director, Mike tended to look after financial matters Though the company had accounts staff who dealt with the day-to-day transactions, there was no one within the company who had any great financial expertise. When there was a problem, the company's auditors were normally asked for advice On the day that the letter from the bank was received, a board meeting was due to take place to consider the draft accounts of the business for the year that had ended two months earlier. At this meeting, the letter from the bank was also distributed to board members for discussie. Mike Greaves began the discussion by saying We've just received the draft accounts from the auditors, which seem to confirma success. Profit has more than doubled. I teally can't see how the cash cation is so poor. I know that we spent a lot on that additional plant and that we didn't get anything from the old machines we get rid of, but most of that was covered by the bank loan Really, the cash situation should be even better than the profit level implies because the expenses include about 12.6 million for depreciation and we don't have to write a cheque for that Jill Dempsey, who was still angry at what she regarded as the high-handed attitude of the bank pointed to the difficulties that the e bank's demands would cause The bank wants us to reduce the overdraft by half over the next six months This is crazy. I tried to explain that we have important orders to fulfil but the manager wasn't interested. How on earth can we find this kind of money in the time available? We are being asked to do the impossible Both Mike and Jill had, before the meeting, hoped that the Keeble brothers would be prepared to help out by purchasing further shares in the company or by making a loan. However, it was soon made clear by David Keeble that further investment was not a possible option. Keeble Estates had been experiencing considerable problems over recent years and simply did not have the money to invest further in Pace Leisurewear. Indeed, the Keeble brothers would be prepared to sell their shares in Pace to generate much-needed cash for their ailing company Finding a prospective bayer for the shares was not, however, a likely prospect at this point. Both David and John Keeble had been heavily involved in recent years with the problems of Keeble Estates and had taken little interest in the affairs of Pace Leisurewear. The board meeting made them realise that they should have been much more attentive, and they now faced the prospect of being major shareholders of two failed companies unless things could be radically improved The accounts of Pace Leisurewear for the past two years are set out below. Last year 22.410 11.610 10.792 6.174 4,618 912 3.700 780 2.926 000 Income statement for the year ended 31 December: Year before last Reverie 14,000 Cost of sales 2498 Gross profit 6,510 Operating expenses 4.410 Operating profit (before interest and taxation) 2,100 Interest payable 432 Profit before taxation 1.668 Taxation 420 Profit for the year 1.248 Note: Dividends proposed in each year 600 These are paid in the following year Balance sheet as at 31 December Year Last year before last 000 E000 Non-current assets 8.600 14.470 Current assets Inventory 2.418 5.820 Trade receivables 1614 3.744 Other receivables 268 402 Cash 56 4.356 9.974 Total assets 12.956 24.444 Equity Ordinary shares of 0.50 each 3.600 3.600 Retained profit 3.274 5.400 6,874 9.000 Non-current liabilities Loan notes 3.600 Current liabilities Trade payables 1214 2.612 Other payables (inc taxation) 1.268 1.982 Bank overdraft 4250 2.482 8.844 Total equity and liabilities 12.956 24.444 The board of directors was not able to agree on a way of dealing with the financial problem faced by the company, Jill believed that their best hope was to continue to wrangle with the bank over its demands. She felt that there was still a chance that the bank could be persuaded to change its mind once the draft accounts for last year were made available and once the bank was informed of the implications for the company of paying off such a large part of the overdraft in such a short period of time. Mike and Jane, on the other hand, were not optimistic about the prospects of changing the bank's position. The company had breached its overdraft limit several occasions over the past few years and they knew that the patience of the bank was now wearing thin The directors believed that the only real solution was to look for someone who was prepared to make a significant investment in the business. They felt that only a large injection of new funds could keep the business on track. Like Jill the other board members believed that the draft accounts demonstrated the success of the business over recent years and that this evidence would make the business attractive to a potential investor. The Keeble brothers rejected both of these views as being impractical in addition, they were against the idea of introducing another major shareholder to the company as this was likely to dilute their influence over the future direction of the business. The brothers believed that drastic and immediate action was required by the board, although they were not sure what form of action should be taken After several hours of discussion, it was clear that the financial issue was not going to be resolved at the meeting. Instead, it was agreed that expertise from outside the company should be sought to help the company find a feasible solution to the problem. The board decided to approach Drake Management Consultants, which specialises in helping businesses with financial problems, and to ask the firm to produce a plan of action for the board's consideration ill agreed to contact the firm of consultants on behalf of the board and to agree to the terms of reference for the work required. She was, however, apprehensive about what the proposed plan of action would contain Immediately after the board meeting se discussed her concerns with Mike. She said, "It seems we have to pay a penalty for our success only hope this penalty won't involve undoing all our good work over the years Required: Assume that you are a member of Drake Management Consultants. Prepare a report for the board of directors of Pace Leisurewear Lad that analyses the problems faced by the company and that sets out a detailed plan of action for dealing with its financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts