Question: 1 part 2 part WIGULO Section 1 of 2 Section #2 v 2. Consider the following details of a stock option: Stock price Strike price

1 part

2 part

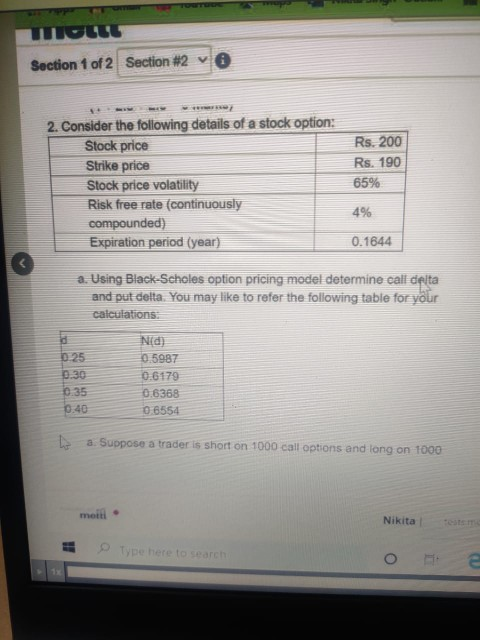

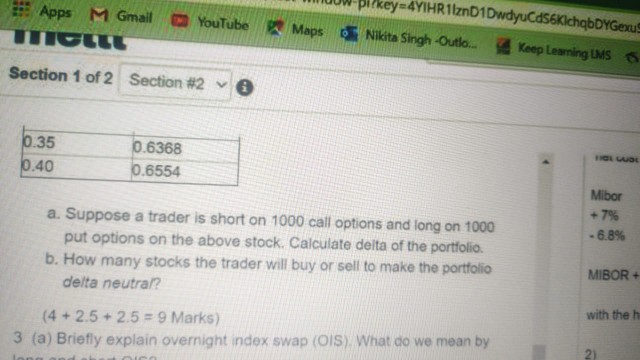

WIGULO Section 1 of 2 Section #2 v 2. Consider the following details of a stock option: Stock price Strike price Stock price volatility Risk free rate (continuously compounded) Expiration period (year) Rs. 200 Rs. 190 65% 4% 0.1644 a. Using Black-Scholes option pricing model determine call delta and put delta. You may like to refer the following table for your calculations d 0 25 Nid) 10.5987 0.6179 0.6368 0.6554 0.35 0.40 La. Suppose a trader is short on 1000 call options and long on 1000 mont Nikita Type here to searc O e Apps M Gmail pi?key=4YIHR1IZD1DwdyuCd56K chqbDYGexu YouTube Maps Nikita Singh Outlo... Keep Learning LMS6 Section 1 of 2 Section #2 0.35 6.40 0.6368 0.6554 HO Mibor + 7% - 6.8% a. Suppose a trader is short on 1000 call options and long on 1000 put options on the above stock. Calculate delta of the portfolio b. How many stocks the trader will buy or sell to make the portfolio delta neutral? MIBOR + with the h (4 + 2.5 + 2.5 = 9 Marks) 3 (a) Briefly explain overnight index swap (OIS). What do we mean by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts