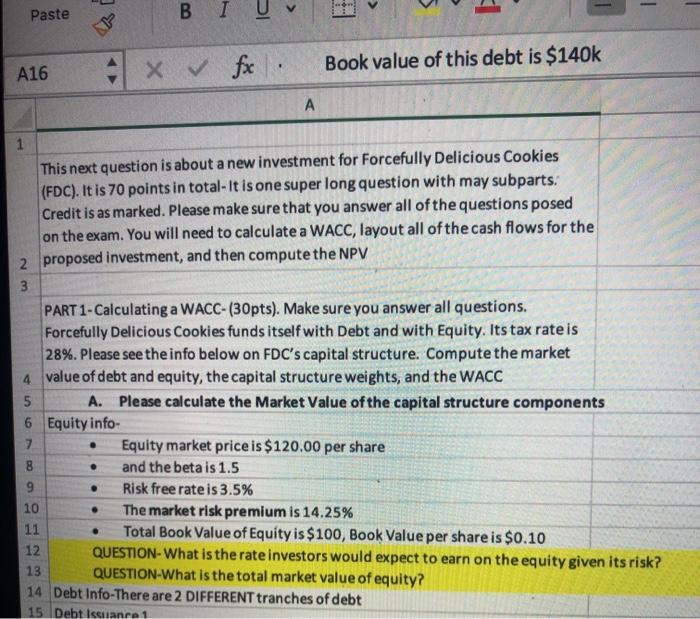

Question: 1 Paste BIU . A16 x & fx Book value of this debt is $140k 1 This next question is about a new investment for

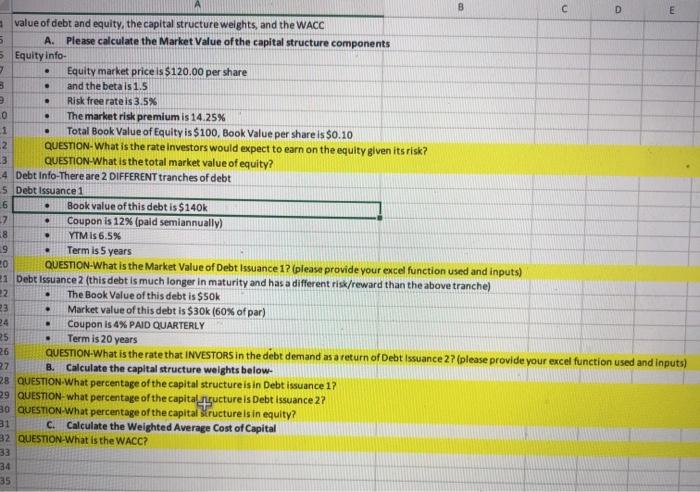

1 Paste BIU . A16 x & fx Book value of this debt is $140k 1 This next question is about a new investment for Forcefully Delicious Cookies (FDC). It is 70 points in total-It is one super long question with may subparts. Credit is as marked. Please make sure that you answer all of the questions posed on the exam. You will need to calculate a WACC, layout all of the cash flows for the 2 proposed investment, and then compute the NPV 3 . PART 1- Calculating a WACC-(30pts). Make sure you answer all questions. Forcefully Delicious Cookies funds itself with Debt and with Equity. Its tax rate is 28%. Please see the info below on FDC's capital structure. Compute the market 4 value of debt and equity, the capital structure weights, and the WACC 5 A. Please calculate the Market Value of the capital structure components 6 Equity info Equity market price is $120.00 per share 8 and the beta is 1.5 9 Risk free rate is 3.5% 10 The market risk premium is 14.25% 11 Total Book Value of Equity is $100, Book Value per share is $0.10 12 QUESTION-What is the rate investors would expect to earn on the equity given its risk? 13 QUESTION-What is the total market value of equity? 14 Debt Info-There are 2 DIFFERENT tranches of debt 15 Debt Issuance 1 . . o c . . . . . . D E a value of debt and equity, the capital structure weights, and the WACC A. Please calculate the Market Value of the capital structure components Equity Info- Equity market price is $120.00 per share 3 and the betals 1.5 Risk free rate is 3.5% 0 The market risk premium is 14.25% 1 Total Book Value of Equity is $100, Book Value per share is $0.10 2 QUESTION-What is the rate Investors would expect to earn on the equity given its risk? 3 QUESTION-What is the total market value of equity? 4 Debt Info-There are 2 DIFFERENT tranches of debt 5 Debt Issuance 1 6 Book value of this debt is $140k -7 Coupon is 12% (paid semiannually) 8 . YTM IS 6.5% 19 Term is 5 years 20 QUESTION-What is the Market Value of Debt Issuance 1? (please provide your excel function used and inputs) e1 Debt Issuance 2 (this debt is much longer in maturity and has a different risk/reward than the above tranche) 22 The Book Value of this debt is $50k 3 Market value of this debt is $30k (60% of par) 24 Coupon is 4% PAID QUARTERLY 25 Term is 20 years 26 QUESTION-What is the rate that INVESTORS in the debt demand as a return of Debt Issuance 27 (please provide your excel function used and inputs) 27 Calculate the capital structure weights below. 28 QUESTION.What percentage of the capital structure is in Debt issuance 1? 29 QUESTION-what percentage of the capital ducture is Debt issuance 2? 30 QUESTION-What percentage of the capital Structure is in equity? Calculate the weighted Average Cost of Capital 32 QUESTION-What is the WACC? 33 34 35 . . . B C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts