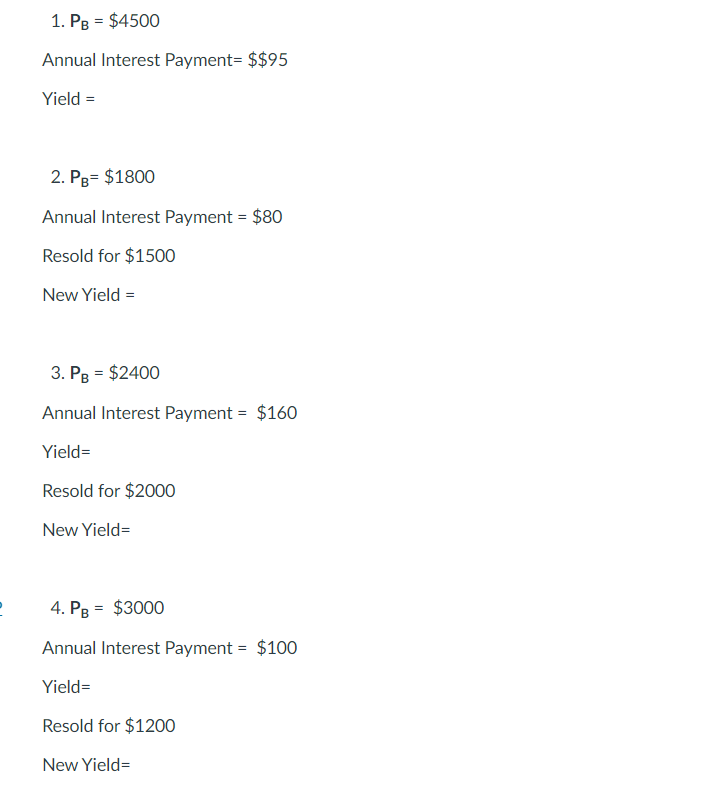

Question: 1. PB = $4500 Annual Interest Payment= $$95 Yield = 2. Pg= $1800 Annual Interest Payment = $80 Resold for $1500 New Yield = 3.

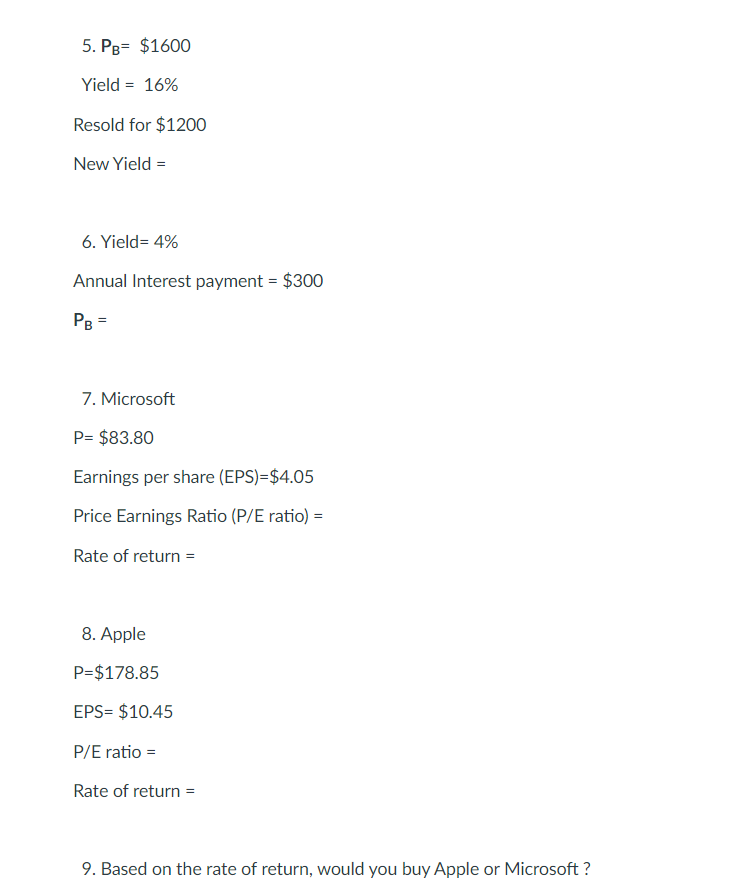

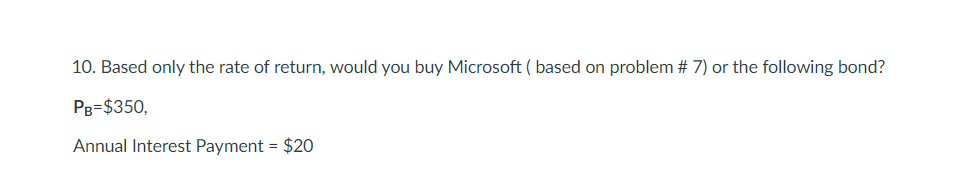

1. PB = $4500 Annual Interest Payment= $$95 Yield = 2. Pg= $1800 Annual Interest Payment = $80 Resold for $1500 New Yield = 3. PB = $2400 Annual Interest Payment = $160 Yield Resold for $2000 New Yield e 4. PB = $3000 Annual Interest Payment = $100 Yield Resold for $1200 New Yield 5. Pe= $1600 Yield = 16% Resold for $1200 New Yield = 6. Yield= 4% Annual Interest payment = $300 PB = 7. Microsoft P= $83.80 Earnings per share (EPS)=$4.05 Price Earnings Ratio (P/E ratio) = Rate of return = 8. Apple P=$178.85 EPS= $10.45 P/E ratio = Rate of return = 9. Based on the rate of return, would you buy Apple or Microsoft ? 10. Based only the rate of return, would you buy Microsoft (based on problem # 7) or the following bond? PB=$350, Annual Interest Payment = $20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts