Question: 1. Perform a 2019 vertical analysis and a 2018-2019 horizontal analysis of the income statements for DMZ, LLC provided below. What areas of concern, if

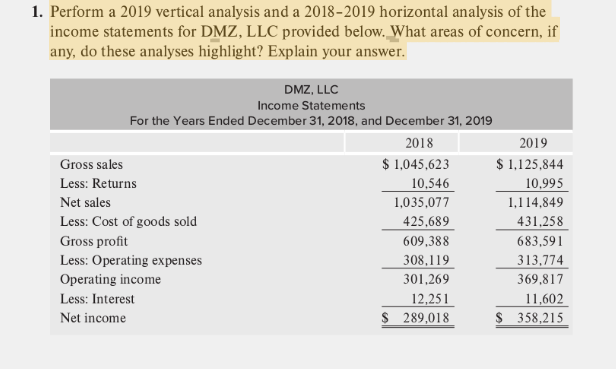

1. Perform a 2019 vertical analysis and a 2018-2019 horizontal analysis of the income statements for DMZ, LLC provided below. What areas of concern, if any, do these analyses highlight? Explain your answer. DMZ, LLC Income Statements For the Years Ended December 31, 2018, and December 31, 2019 2018 2019 Gross sales $ 1,045.623 $ 1.125.844 Less: Returns 10,546 10.995 Net sales 1,035,077 1,114,849 Less: Cost of goods sold 425,689 431,258 Gross profit 609,388 683,591 Less: Operating expenses 308,119 313,774 Operating income 301,269 369,817 Less: Interest 12,251 11,602 Net income $ 289,018 $ 358,215 1. Perform a 2019 vertical analysis and a 2018-2019 horizontal analysis of the income statements for DMZ, LLC provided below. What areas of concern, if any, do these analyses highlight? Explain your answer. DMZ, LLC Income Statements For the Years Ended December 31, 2018, and December 31, 2019 2018 2019 Gross sales $ 1,045.623 $ 1.125.844 Less: Returns 10,546 10.995 Net sales 1,035,077 1,114,849 Less: Cost of goods sold 425,689 431,258 Gross profit 609,388 683,591 Less: Operating expenses 308,119 313,774 Operating income 301,269 369,817 Less: Interest 12,251 11,602 Net income $ 289,018 $ 358,215

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts