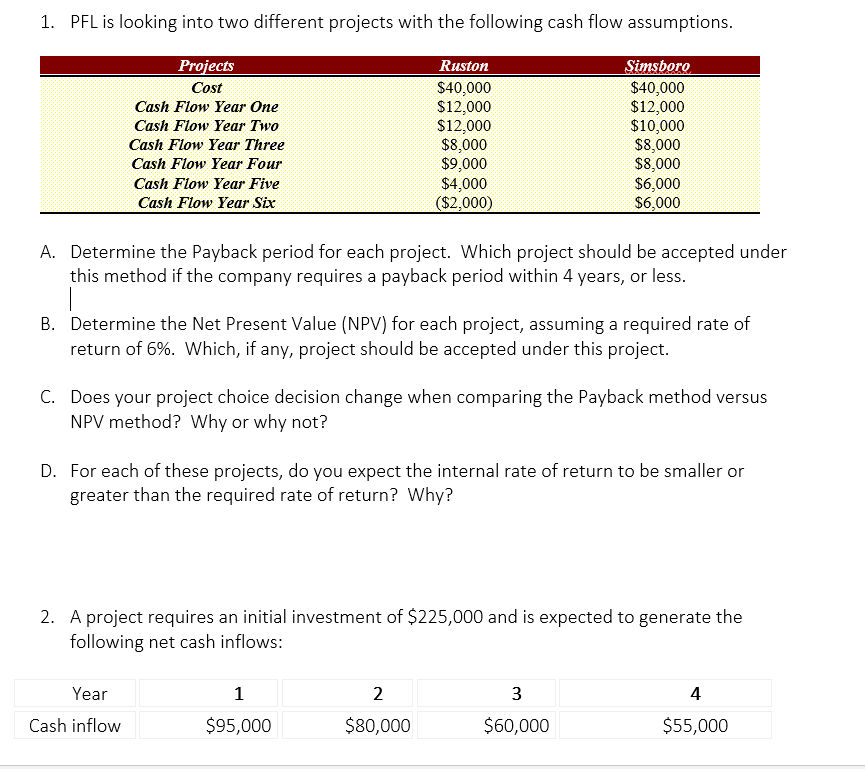

Question: 1. PFL is looking into two different projects with the following cash flow assumptions Projects Cost Cash Flow Year One Cash Flow Year Two Cash

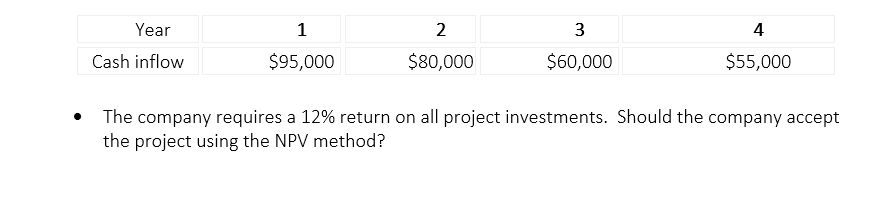

1. PFL is looking into two different projects with the following cash flow assumptions Projects Cost Cash Flow Year One Cash Flow Year Two Cash Flow Year Three Cash Flow Year Four Cash Flow Year Five Cash Flow Year Sie Ruston $40,000 $12,000 $12,000 $8,000 $9,000 $4,000 (S2,000) Simsboro $40,000 $12,000 $10,000 $8,000 $8,000 $6,000 $6,000 A. Determine the Payback period for each project. Which project should be accepted under this method if the company requires a payback period within 4 years, or less B. Determine the Net Present Value (NPV) for each project, assuming a required rate of return of 6%, which, if any, project should be accepted under this project C. Does your project choice decision change when comparing the Payback method versus NPV method? Why or why not? D. For each of these projects, do you expect the internal rate of return to be smaller or greater than the required rate of return? Why? A project requires an initial investment of $225,000 and is expected to generate the following net cash inflows 2. Year 2 4 Cash inflow $95,000 $80,000 $60,000 $55,000 Year 2 3 4 Cash inflow $95,000 $80,000 $60,000 $55,000 The company requires a 12% return on all project investments. Should the company accept the project using the NPV method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts