Question: 1. Phoenix College is considering a new certificate program in the at-home brain surgery that is anticipated to attract 8 students. It is anticipated

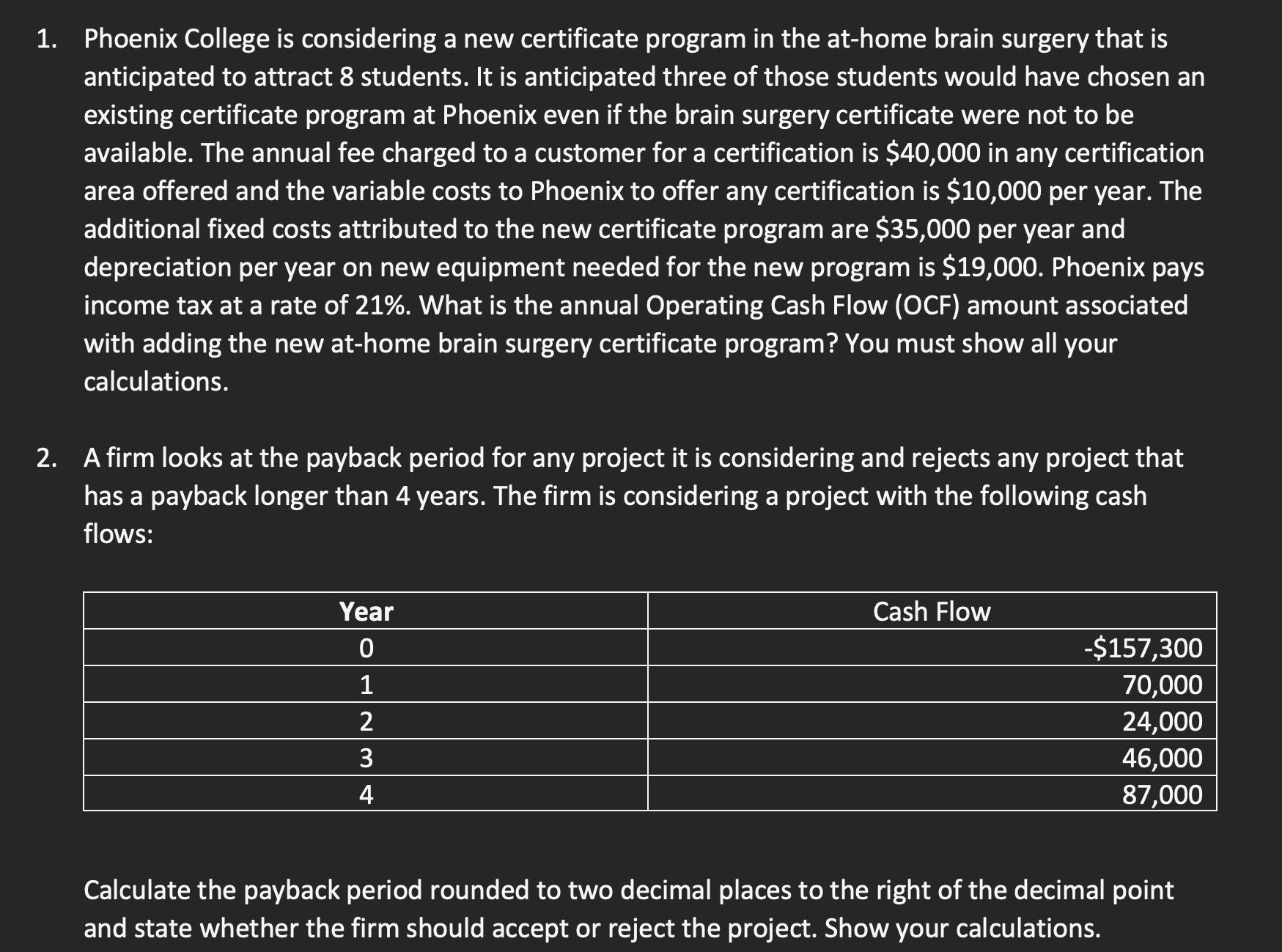

1. Phoenix College is considering a new certificate program in the at-home brain surgery that is anticipated to attract 8 students. It is anticipated three of those students would have chosen an existing certificate program at Phoenix even if the brain surgery certificate were not to be available. The annual fee charged to a customer for a certification is $40,000 in any certification area offered and the variable costs to Phoenix to offer any certification is $10,000 per year. The additional fixed costs attributed to the new certificate program are $35,000 per year and depreciation per year on new equipment needed for the new program is $19,000. Phoenix pays income tax at a rate of 21%. What is the annual Operating Cash Flow (OCF) amount associated with adding the new at-home brain surgery certificate program? You must show all your calculations. 2. A firm looks at the payback period for any project it is considering and rejects any project that has a payback longer than 4 years. The firm is considering a project with the following cash flows: Year 0 1 2 3 4 Cash Flow -$157,300 70,000 24,000 46,000 87,000 Calculate the payback period rounded to two decimal places to the right of the decimal point and state whether the firm should accept or reject the project. Show your calculations.

Step by Step Solution

3.32 Rating (158 Votes )

There are 3 Steps involved in it

1 Calculate the annual Operating Cash Flow OCF for the new athome brain surgery certificate program ... View full answer

Get step-by-step solutions from verified subject matter experts