Question: 1. Pick a stock and answer whether or not it is a good time to buy. You must use technical analysis, dividend valuation and fundamental

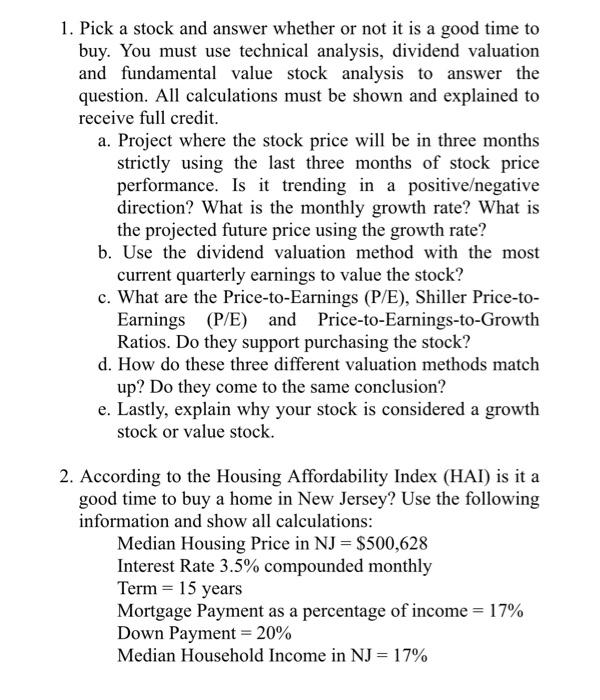

1. Pick a stock and answer whether or not it is a good time to buy. You must use technical analysis, dividend valuation and fundamental value stock analysis to answer the question. All calculations must be shown and explained to receive full credit. a. Project where the stock price will be in three months strictly using the last three months of stock price performance. Is it trending in a positiveegative direction? What is the monthly growth rate? What is the projected future price using the growth rate? b. Use the dividend valuation method with the most current quarterly earnings to value the stock? c. What are the Price-to-Earnings (P/E), Shiller Price-to- Earnings (P/E) and Price-to-Earnings-to-Growth Ratios. Do they support purchasing the stock? d. How do these three different valuation methods match up? Do they come to the same conclusion? e. Lastly, explain why your stock is considered a growth stock or value stock. 2. According to the Housing Affordability Index (HAI) is it a good time to buy a home in New Jersey? Use the following information and show all calculations: Median Housing Price in NJ = $500,628 Interest Rate 3.5% compounded monthly Term = 15 years Mortgage Payment as a percentage of income = 17% Down Payment = 20% Median Household Income in NJ = 17% 1. Pick a stock and answer whether or not it is a good time to buy. You must use technical analysis, dividend valuation and fundamental value stock analysis to answer the question. All calculations must be shown and explained to receive full credit. a. Project where the stock price will be in three months strictly using the last three months of stock price performance. Is it trending in a positiveegative direction? What is the monthly growth rate? What is the projected future price using the growth rate? b. Use the dividend valuation method with the most current quarterly earnings to value the stock? c. What are the Price-to-Earnings (P/E), Shiller Price-to- Earnings (P/E) and Price-to-Earnings-to-Growth Ratios. Do they support purchasing the stock? d. How do these three different valuation methods match up? Do they come to the same conclusion? e. Lastly, explain why your stock is considered a growth stock or value stock. 2. According to the Housing Affordability Index (HAI) is it a good time to buy a home in New Jersey? Use the following information and show all calculations: Median Housing Price in NJ = $500,628 Interest Rate 3.5% compounded monthly Term = 15 years Mortgage Payment as a percentage of income = 17% Down Payment = 20% Median Household Income in NJ = 17%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts