Question: 1. Pick one S&P 500 firm for your case study. You are welcome to consult with your professor about your pick before you start. 2.

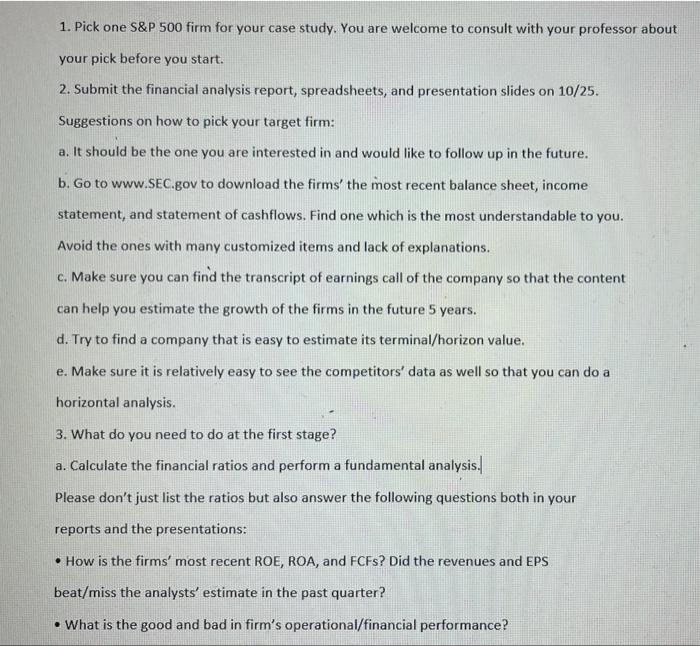

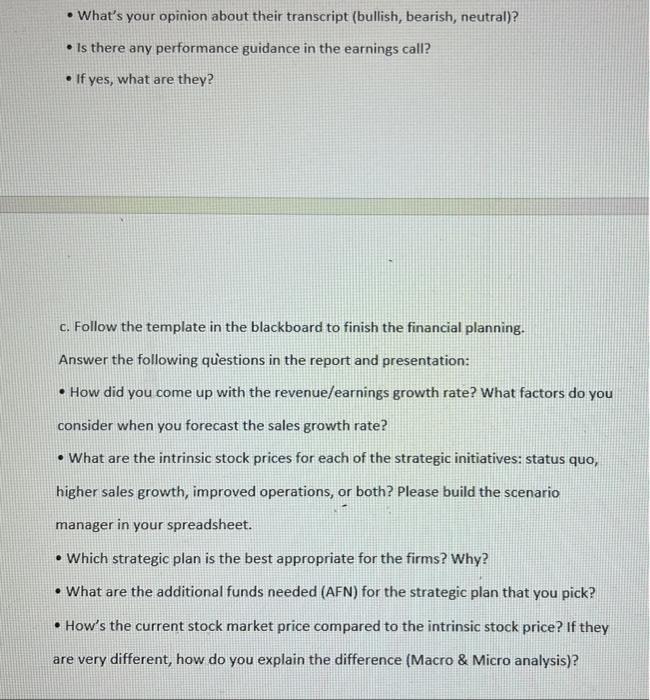

1. Pick one S\&P 500 firm for your case study. You are welcome to consult with your professor about your pick before you start. 2. Submit the financial analysis report, spreadsheets, and presentation slides on 10/25. Suggestions on how to pick your target firm: a. It should be the one you are interested in and would like to follow up in the future. b. Go to www.SEC.gov to download the firms' the most recent balance sheet, income statement, and statement of cashflows. Find one which is the most understandable to you. Avoid the ones with many customized items and lack of explanations. c. Make sure you can find the transcript of earnings call of the company so that the content can help you estimate the growth of the firms in the future 5 years. d. Try to find a company that is easy to estimate its terminal/horizon value. e. Make sure it is relatively easy to see the competitors' data as well so that you can do a horizontal analysis. 3. What do you need to do at the first stage? a. Calculate the financial ratios and perform a fundamental analysis.| Please don't just list the ratios but also answer the following questions both in your reports and the presentations: - How is the firms' most recent ROE, ROA, and FCFs? Did the revenues and EPS beat/miss the analysts' estimate in the past quarter? - What is the good and bad in firm's operational/financial performance? - What's your opinion about their transcript (bullish, bearish, neutral)? - Is there any performance guidance in the earnings call? - If yes, what are they? c. Follow the template in the blackboard to finish the financial planning. Answer the following quiestions in the report and presentation: - How did you come up with the revenue/earnings growth rate? What factors do you consider when you forecast the sales growth rate? - What are the intrinsic stock prices for each of the strategic initiatives: status quo, higher sales growth, improved operations, or both? Please build the scenario manager in your spreadsheet. - Which strategic plan is the best appropriate for the firms? Why? - What are the additional funds needed (AFN) for the strategic plan that you pick? - How's the current stock market price compared to the intrinsic stock price? If they are very different, how do you explain the difference (Macro \& Micro analysis)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts