Question: 1. Please answer the required questions(a,b) 2. Please answer the required questions(a,b) . Management of Tarry Company takes the position that under the lower-of-cost-or-market rule,

1. Please answer the required questions(a,b)

Please answer the required questions(a,b)

2.

Please answer the required questions(a,b)

Please answer the required questions(a,b)

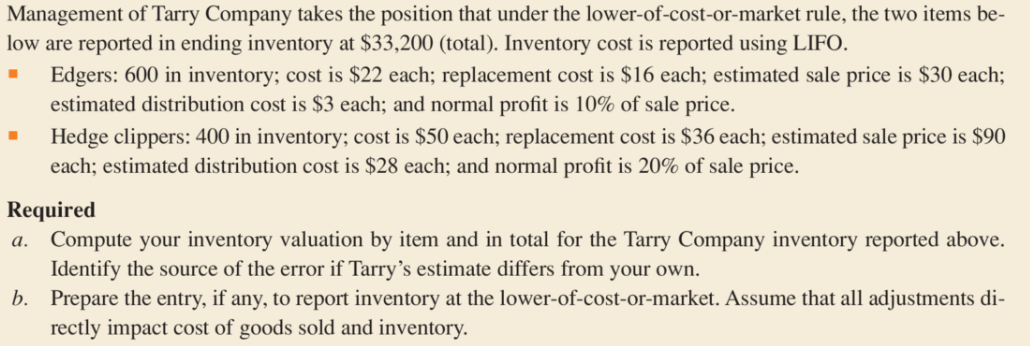

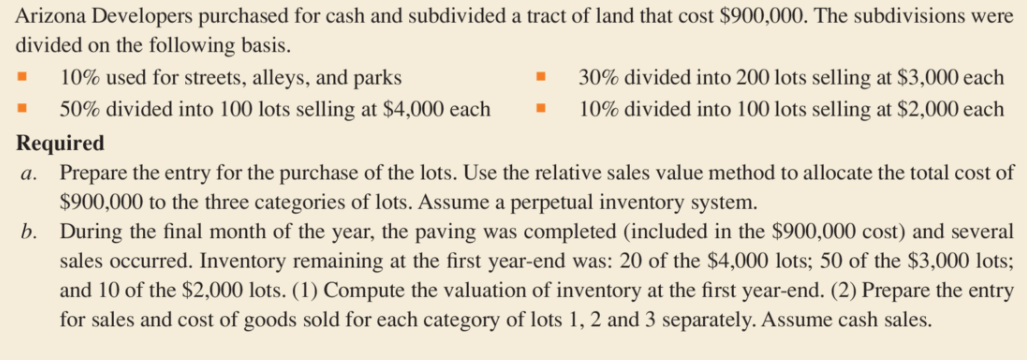

. Management of Tarry Company takes the position that under the lower-of-cost-or-market rule, the two items be- low are reported in ending inventory at $33,200 (total). Inventory cost is reported using LIFO. Edgers: 600 in inventory; cost is $22 each; replacement cost is $16 each; estimated sale price is $30 each; estimated distribution cost is $3 each; and normal profit is 10% of sale price. Hedge clippers: 400 in inventory; cost is $50 each; replacement cost is $36 each; estimated sale price is $90 each; estimated distribution cost is $28 each; and normal profit is 20% of sale price. Required a. Compute your inventory valuation by item and in total for the Tarry Company inventory reported above. Identify the source of the error if Tarrys estimate differs from your own. b. Prepare the entry, if any, to report inventory at the lower-of-cost-or-market. Assume that all adjustments di- rectly impact cost of goods sold and inventory. . . . Arizona Developers purchased for cash and subdivided a tract of land that cost $900,000. The subdivisions were divided on the following basis. 10% used for streets, alleys, and parks 30% divided into 200 lots selling at $3,000 each 50% divided into 100 lots selling at $4,000 each 10% divided into 100 lots selling at $2,000 each Required Prepare the entry for the purchase of the lots. Use the relative sales value method to allocate the total cost of $900,000 to the three categories of lots. Assume a perpetual inventory system. b. During the final month of the year, the paving was completed (included in the $900,000 cost) and several sales occurred. Inventory remaining at the first year-end was: 20 of the $4,000 lots; 50 of the $3,000 lots; and 10 of the $2,000 lots. (1) Compute the valuation of inventory at the first year-end. (2) Prepare the entry for sales and cost of goods sold for each category of lots 1, 2 and 3 separately. Assume cash sales. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts