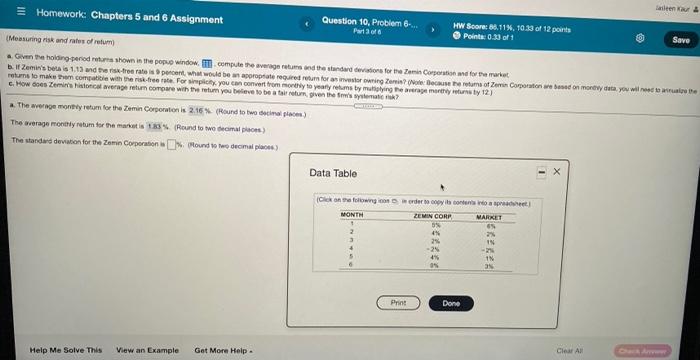

Question: 1. PLEASE ANSWER THESE ASAP 2. Silen Homework: Chapters 5 and 6 Assignment Question 10. Problem - HW Score: 86.11.10.33 of 12 points Foto Points:

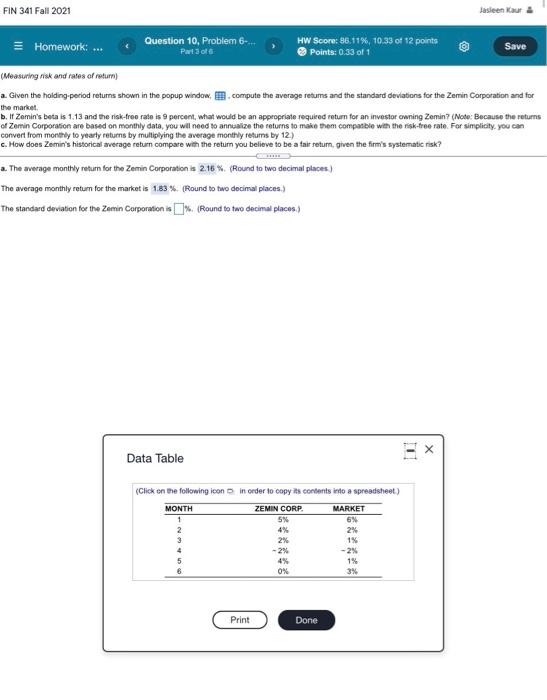

Silen Homework: Chapters 5 and 6 Assignment Question 10. Problem - HW Score: 86.11.10.33 of 12 points Foto Points: 0.33 of 1 Save Measuring risk and rates of retum the holding period returns shown in the popuo window.computer agentumsand the standard deviation for me Zemin Corporation for the market Zemin's beta is 1.15 and the strate is prout what would be more red run for a string Zone Because the retums of Zes Corporation bed on more det, you will to write returns to make the compatible with it. Fering you can control yearly by my heerey mun by 12) c. How does Zein istorical wage retum compare with the return you believe to be a gente se? a. The average money retum for the Zemin Corporation is 2.16. Round to imple) The average monthly retum for the market 83% Round to we decimals) The standard deviation for the Zamien Corporation Is Mound to decimal places) Data Table Click on the following order toyibotlar MONTH ZEMIN CORP MARKET 49 24 -25 4% - IN Print Done Help Me Solve This View an Example Get More Help Clear All FIN 341 Fall 2021 Jasleen Kaur = Homework: ... Question 10, Problem 6 HW Score: 86.11%, 10.33 of 12 points Save Part 3 of Points: 0.33 of 1 Measuring risk and rates of rotum) a. Given the holding period returns shown in the popup window.compute the average returns and the standard deviations for the Zemin Corporation and for the market b. If Zemin's beta is 1.13 and the risk-free rate is 9 percent, what would be an appropriate required return for an investor awning Zemin? (Note: Because the returns of Zemin Corporation are based on monthly date, you will need to annualize the returns to make them compatible with the risk-free rate. For simplicity you can convert from monthly to yearly returns by multiplying the average monthly returns by 12) c. How does Zemin's historical average return compare with the return you believe to be a fait return, given the firm's systematic risk? a. The average monthly return for the Zemin Corporation is 2.16%(Round to two decimal places) The average monthly return for the market is 1.83% (Round to two decimal places) The standard deviation for the Zamin Corporation is 0% (Round to two decimal places) Data Table (Click on the following icon in order to copy its contents into a spreadsheet MONTH ZEMIN CORP MARKET 5% 6% 2 4% 2% 2% 1% 4 - 2% -2% 4% 1% 6 0% 3% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts