Question: 1. Please complete correctly and i will give a thumbs up Required information [The following information applies to the questions displayed below) Megamart provides the

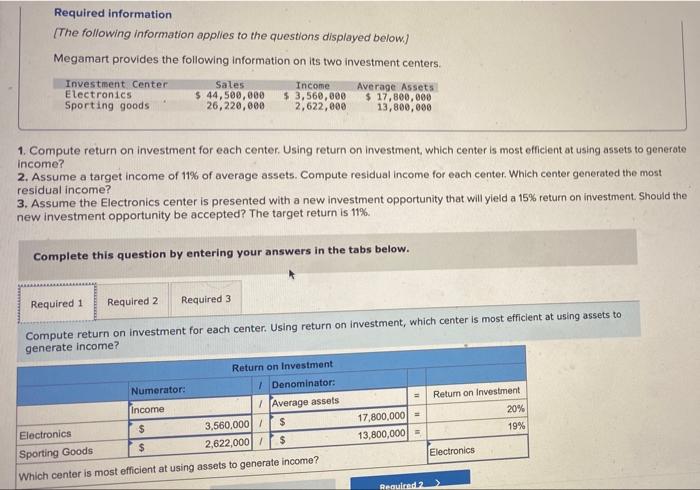

Required information [The following information applies to the questions displayed below) Megamart provides the following information on its two investment centers. Investment Center Electronics Sporting goods Sales $ 44,500,000 26,220,000 Income 5 3,560,000 2,622,000 Average Assets $ 17,800,000 13,800,000 1. Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to generate Income? 2. Assume a target income of 11% of average assets. Compute residual income for each center. Which center generated the most residual income? 3. Assume the Electronics center is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted? The target return is 11%, Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to generate income? Return on Investment Numerator: Denominator: Income Average assets Electronics $ 3,560,000/ $ Sporting Goods $ 2,622,000/ $ Which center is most efficient at using assets to generate income? Return on Investment 20% 19% 17,800,000 13,800,000/= Electronics Required 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts