Question: #1) please help me with x marks... #2) i only need help with letter i please. Required information [The following information applies to the questions

#1) please help me with x marks...

![questions displayed below.] Vail Resorts, Inc., owns and operates 11 premier year-round](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e87613214ec_61066e87612b1d44.jpg)

#2) i only need help with letter i please.

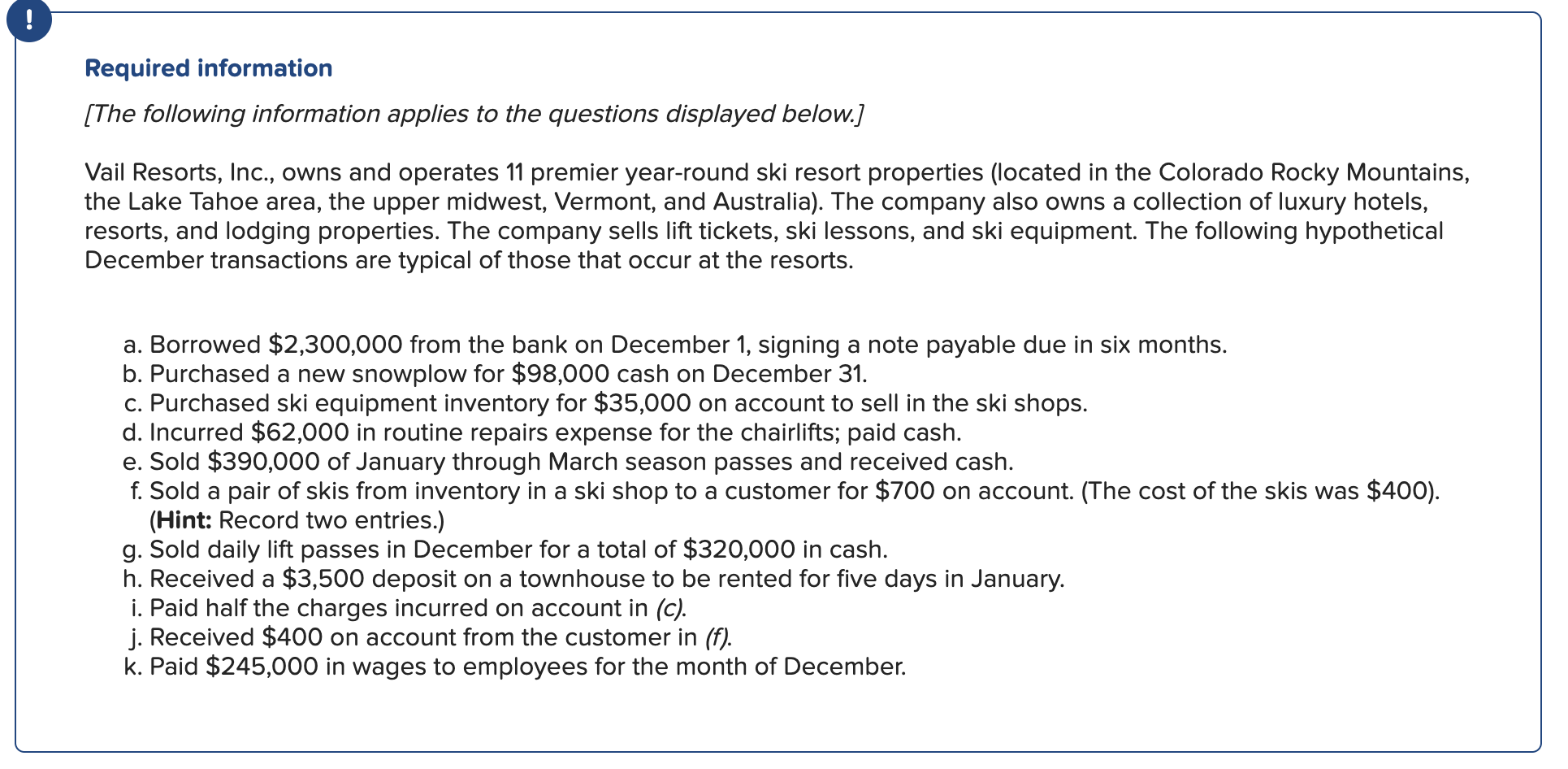

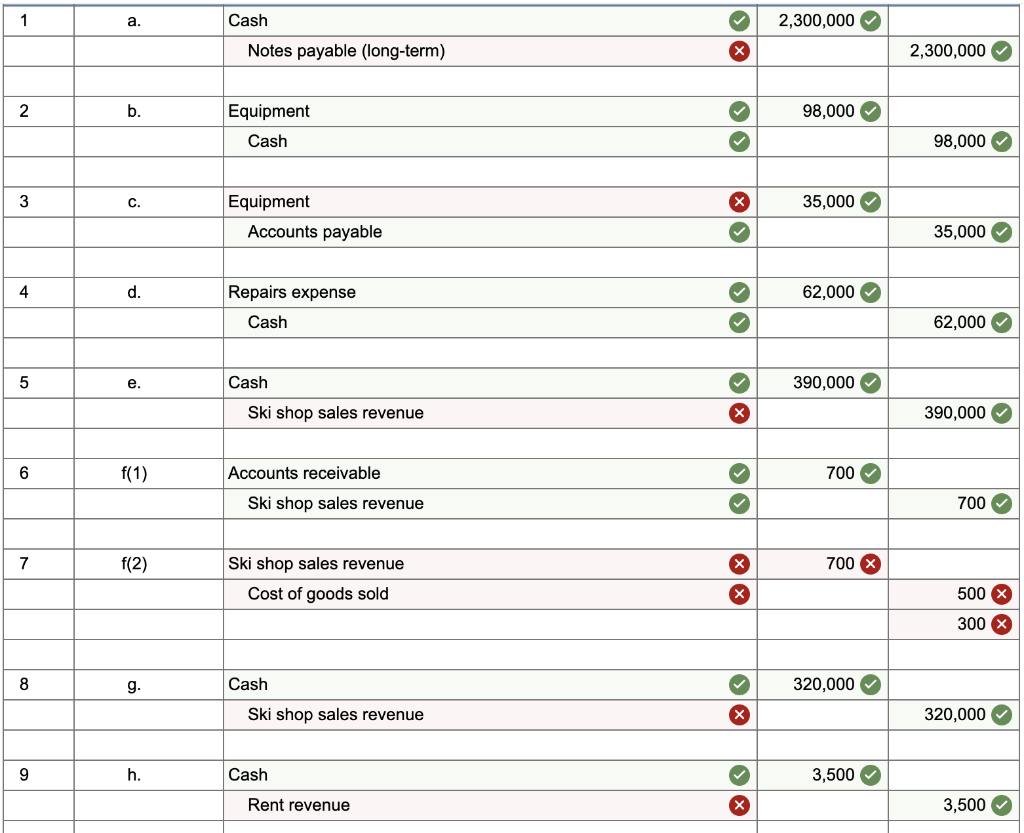

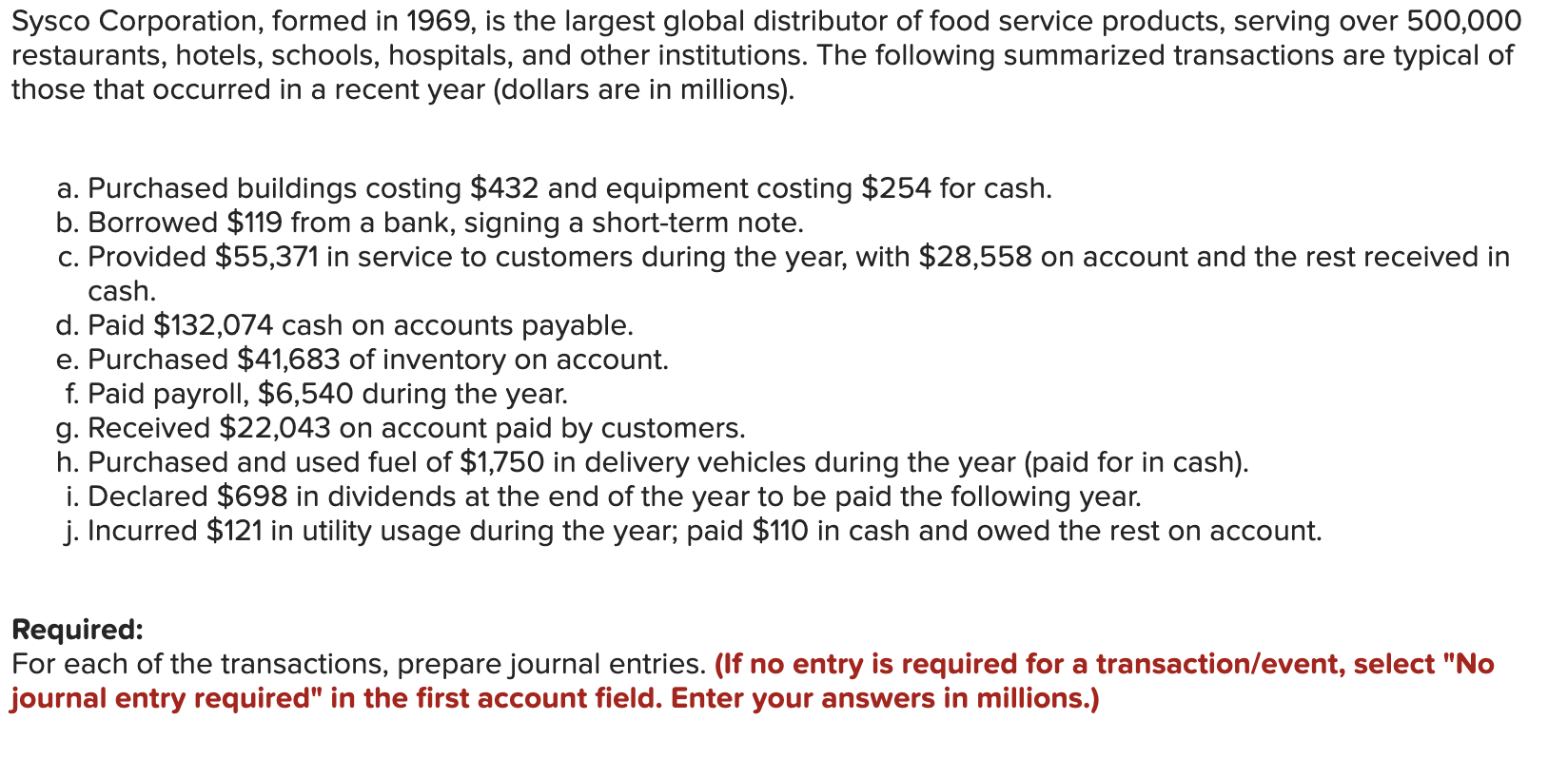

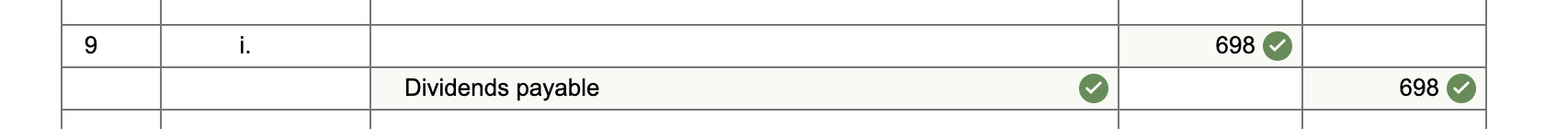

Required information [The following information applies to the questions displayed below.] Vail Resorts, Inc., owns and operates 11 premier year-round ski resort properties (located in the Colorado Rocky Mountains, the Lake Tahoe area, the upper midwest, Vermont, and Australia). The company also owns a collection of luxury hotels, resorts, and lodging properties. The company sells lift tickets, ski lessons, and ski equipment. The following hypothetical December transactions are typical of those that occur at the resorts. a. Borrowed $2,300,000 from the bank on December 1, signing a note payable due in six months. b. Purchased a new snowplow for $98,000 cash on December 31. c. Purchased ski equipment inventory for $35,000 on account to sell in the ski shops. d. Incurred $62,000 in routine repairs expense for the chairlifts; paid cash. e. Sold $390,000 of January through March season passes and received cash. f. Sold a pair of skis from inventory in a ski shop to a customer for $700 on account. (The cost of the skis was $400). (Hint: Record two entries.) g. Sold daily lift passes in December for a total of $320,000 in cash. h. Received a $3,500 deposit on a townhouse to be rented for five days in January. i. Paid half the charges incurred on account in (c). j. Received $400 on account from the customer in (f). k. Paid $245,000 in wages to employees for the month of December. a. 2,300,000 Cash Notes payable (long-term) 2,300,000 b. 98,000 Equipment Cash 98,000 | 3 35,000 Equipment Accounts payable 35,000 d. 62,000 Repairs expense Cash 62,000 e. 390,000 Cash Ski shop sales revenue 390,000 f(1) 700 Accounts receivable Ski shop sales revenue 700 f(2) 700 X Ski shop sales revenue Cost of goods sold 500 300 X 8 g. 320,000 Cash Ski shop sales revenue 320,000 h. 3,500 Cash Rent revenue 3,500 2. Assume that Vail Resorts had a $1,000 balance in Accounts Receivable at the beginning of December. Determine the ending balance in the Accounts Receivable account at the end of December based on transactions (a) through (k). Ending balance in Accounts receivable Sysco Corporation, formed in 1969, is the largest global distributor of food service products, serving over 500,000 restaurants, hotels, schools, hospitals, and other institutions. The following summarized transactions are typical of those that occurred in a recent year (dollars are in millions). a. Purchased buildings costing $432 and equipment costing $254 for cash. b. Borrowed $119 from a bank, signing a short-term note. c. Provided $55,371 in service to customers during the year, with $28,558 on account and the rest received in cash. d. Paid $132,074 cash on accounts payable. e. Purchased $41,683 of inventory on account. f. Paid payroll, $6,540 during the year. g. Received $22,043 on account paid by customers. h. Purchased and used fuel of $1,750 in delivery vehicles during the year (paid for in cash). i. Declared $698 in dividends at the end of the year to be paid the following year. j. Incurred $121 in utility usage during the year; paid $110 in cash and owed the rest on account. Required: For each of the transactions, prepare journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions.) 698 Dividends payable 698

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts