Question: 1 please help thank you 2 Net Present Value Method-Annuity Briggs Excavation Company is planning an investment of $539,600 for a bulldozer. The bulldozer is

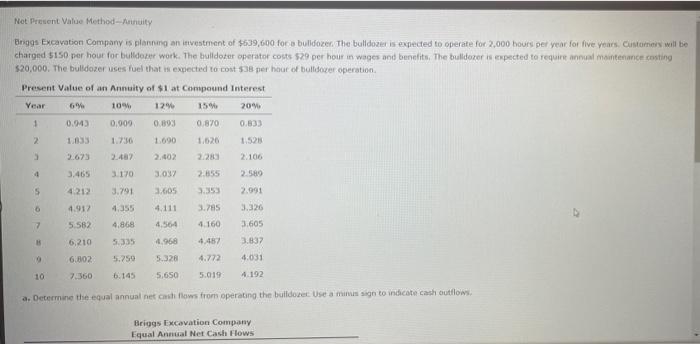

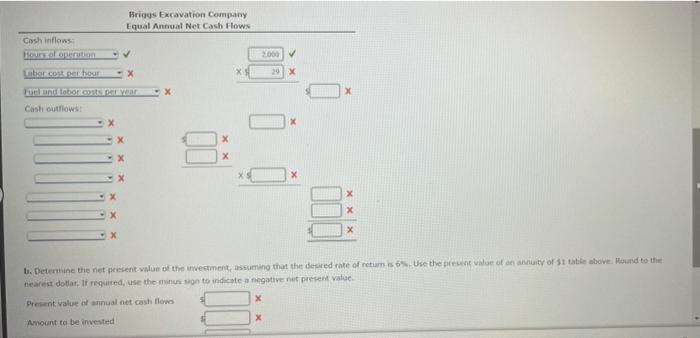

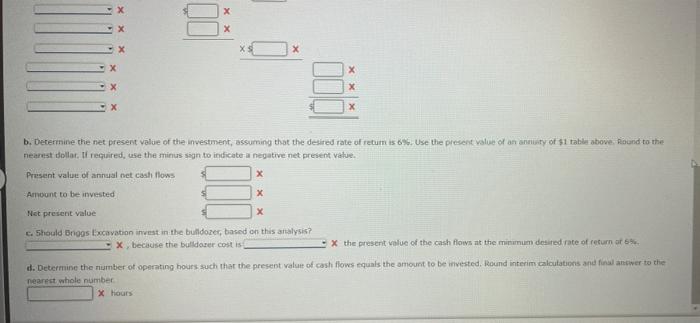

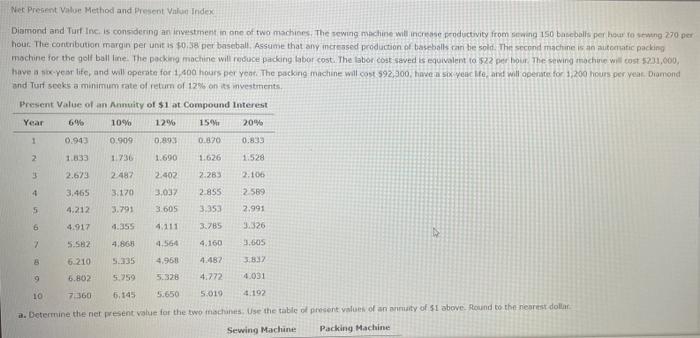

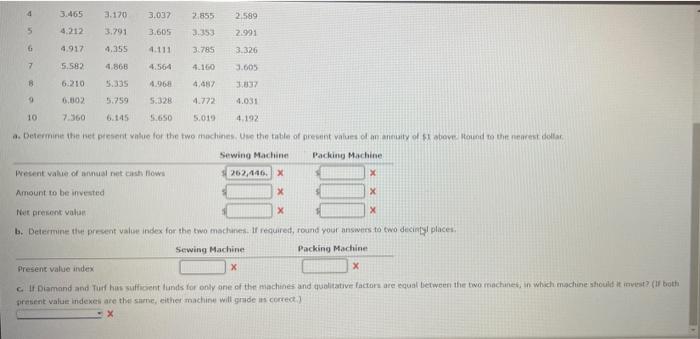

Net Present Value Method-Annuity Briggs Excavation Company is planning an investment of $539,600 for a bulldozer. The bulldozer is expected to operate for 2,000 hours per year for five years. Customers will be charged $150 per hour for bulldozer work. The bulldozer operator costs $29 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $20,000. The bulldozer uses fuel that is expected to cost $38 per hour of bulldozer operation. Present Value of an Annuity of $1 at Compound Interest. Year 6% 10% 12% 15% 20% 1 0.943 0,909 0.893 0.870 0.833 1.690 1.528 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.353 2.991 4.917 4.355 4.111 3.785 3.326 5.582 4.868 4.564 4.160 3.605 6,210 5.335 4.968 4.487 3.837 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine the equal annual net cash flows from operating the bulldozer. Use a minus sign to indicate cash outflows. Briggs Excavation Company Equal Annual Net Cash Flows 2 4 5 6 17 B 19 Cash inflows: Hours of operation Labor cost per hour Cash outflows: Briggs Excavation Company Equal Annual Net Cash Flows -X X x -x -x -X 2.000 29 X X X -X X X X -x b. Determine the net present value of the investment, assuming that the desired rate of retum is 6%. Use the present value of an annuity of $1 table above. Hound to the nearest dollar. If required, use the minus sign to indicate a negative net present value. Present value of annual net cash flows X Amount to be invested X X X X -X X b. Determine the net present value of the investment, assuming that the desired rate of retum is 6%. Use the present value of an annuity of $1 table above. Round to the nearest dollar. If required, use the minus sign to indicate a negative net present value. Present value of annual net cash flows x Amount to be invested X Net present value X c. Should Briggs Excavation invest in the bulldozer, based on this analysis? X, because the bulldozer cost is X the present value of the cash flows at the minimum desired rate of return of 6% d. Determine the number of operating hours such that the present value of cash flows equals the amount to be invested. Round interim calculations and final answer to the nearest whole number X hours x X X X Net Present Value Method and Present Value Index Diamond and Turf Inc. is considering an investment in one of two machines. The sewing machine will increase productivity from sewing 150 baseballs per hour to sewing 270 per hour. The contribution margin per unit is $0.38 per baseball. Assume that any increased production of baseballs can be sold. The second machine is an automatic packing machine for the golf ball line. The packing machine will reduce packing labor cost. The labor cost saved is equivalent to $22 per hour. The sewing machine will cost $231,000, have a six-year life, and will operate for 1,400 hours per year. The packing machine will cost $92,000, have a six yeac Me, and will operate for 1,200 hours per year. Diamond and Turf seeks a minimum rate of return of 12% on its investments. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3,465) 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.353 2.991 4.917 4.355 4.111 3.785 3.326 4 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 5.759 6.802 5.328 4.031 4.772 10 7:360 6.145 5.650 5.019 4.192 a. Determine the net present value for the two machines. Use the table of present values of an annuity of $1 above. Round to the nearest dollar Sewing Machine Packing Machine 5 6 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 3.353 2.991 G 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 B 6.210 5.335 4.968 4.487 3.837 9 5.759 5.328 4.772 4.031 10. 7.360 6.145 5.650 5.019 4.192 a. Determine the net present value for the two machines. Use the table of present values of an annuity of $1 above. Round to the nearest dollar Sewing Machine Packing Machine Present value of annual net cash flows 262,446. X X Amount to be invested X X Net present value X b. Determine the present value index for the two machines. If required, round your answers to two decintal places. Sewing Machine X Packing Machine X Present value index c. If Diamond and Turf has sufficient funds for only one of the machines and qualitative factors are equal between the two machines, in which machine should it invest? (If both present value indexes are the same, either machine will grade as correct.) X 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts