Question: 1. Please help with a and B Hyperion Inc., currently sells its latest high-speed color printer, the Hyper 500, for $341. It plans to lower

1. Please help with a and B

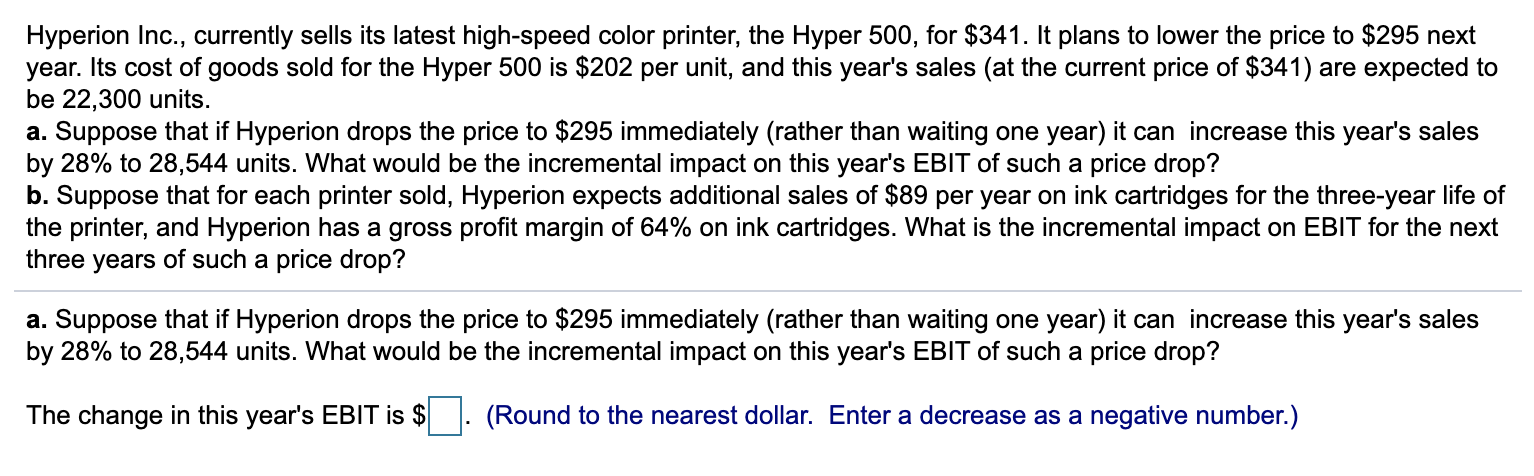

Hyperion Inc., currently sells its latest high-speed color printer, the Hyper 500, for $341. It plans to lower the price to $295 next year. Its cost of goods sold for the Hyper 500 is $202 per unit, and this year's sales (at the current price of $341) are expected to be 22,300 units. a. Suppose that if Hyperion drops the price to $295 immediately (rather than waiting one year) it can increase this year's sales by 28% to 28,544 units. What would be the incremental impact on this year's EBIT of such a price drop? b. Suppose that for each printer sold, Hyperion expects additional sales of $89 per year on ink cartridges for the three-year life of the printer, and Hyperion has a gross profit margin of 64% on ink cartridges. What is the incremental impact on EBIT for the next three years of such a price drop? a. Suppose that if Hyperion drops the price to $295 immediately (rather than waiting one year) it can increase this year's sales by 28% to 28,544 units. What would be the incremental impact on this year's EBIT of such a price drop? The change in this year's EBIT is $ (Round to the nearest dollar. Enter a decrease as a negative number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts