Question: 1) Please journalize below transactions for both sides (debtor & creditor) and prepare an Income Statement & Balance Sheet for both entities as of May

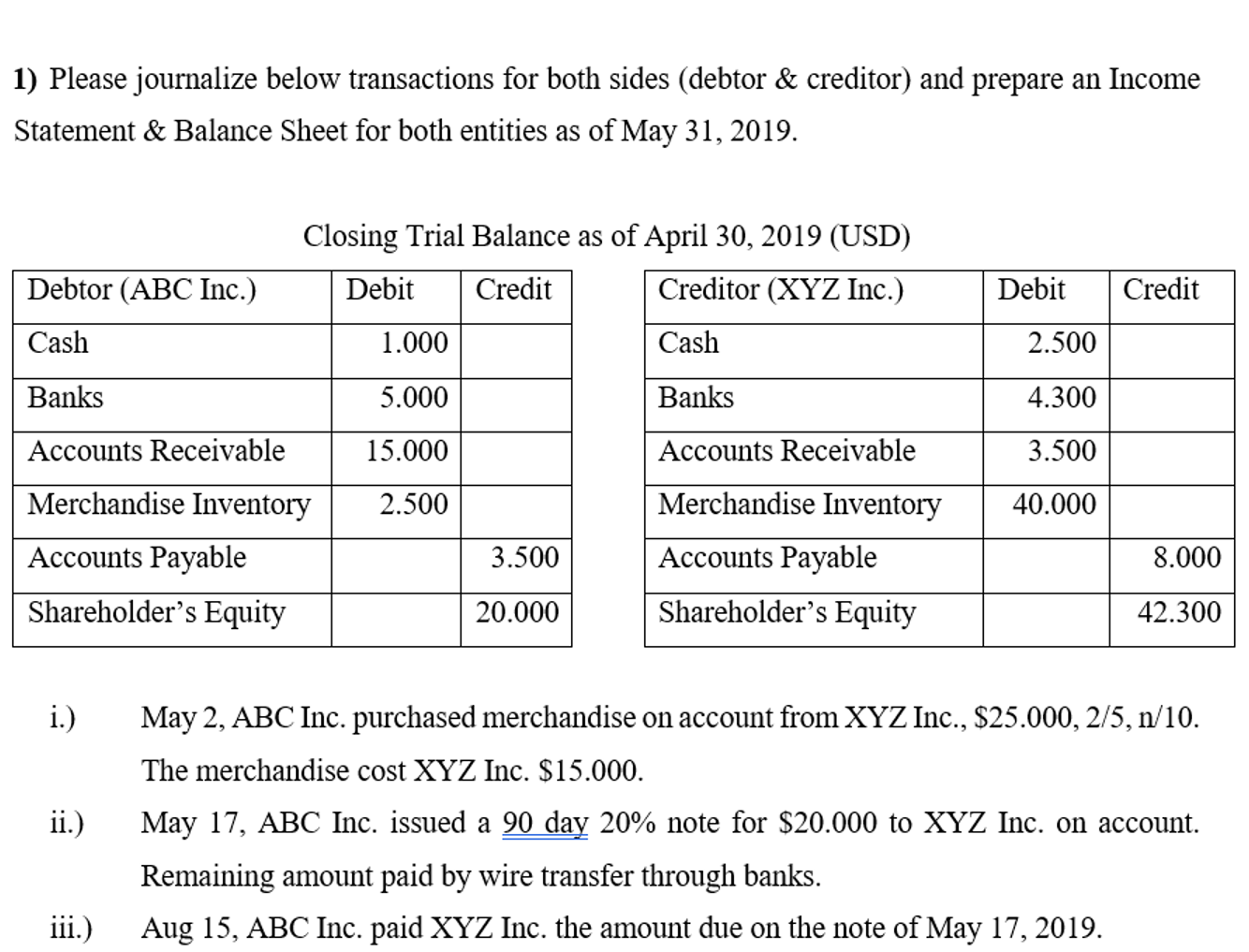

1) Please journalize below transactions for both sides (debtor & creditor) and prepare an Income Statement & Balance Sheet for both entities as of May 31, 2019. Closing Trial Balance as of April 30, 2019 (USD) Debit Credit Creditor (XYZ Inc.) Debtor (ABC Inc.) Debit Credit Cash 1.000 Cash 2.500 Banks 5.000 Banks 4.300 Accounts Receivable 15.000 Accounts Receivable 3.500 2.500 40.000 Merchandise Inventory Accounts Payable Shareholder's Equity 3.500 Merchandise Inventory Accounts Payable Shareholder's Equity 8.000 20.000 42.300 i.) May 2, ABC Inc. purchased merchandise on account from XYZ Inc., $25.000, 2/5, n/10. The merchandise cost XYZ Inc. $15.000. ii.) May 17, ABC Inc. issued a 90 day 20% note for $20.000 to XYZ Inc. on account. Remaining amount paid by wire transfer through banks. Aug 15, ABC Inc. paid XYZ Inc. the amount due on the note of May 17, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts