Question: 1. Please provide an analysis accessing the situation and explain what you think the company should do. (100-200 words) Western States Fire Protection Co's (WSFPC)

1. Please provide an analysis accessing the situation and explain what you think the company should do. (100-200 words)

1. Please provide an analysis accessing the situation and explain what you think the company should do. (100-200 words)

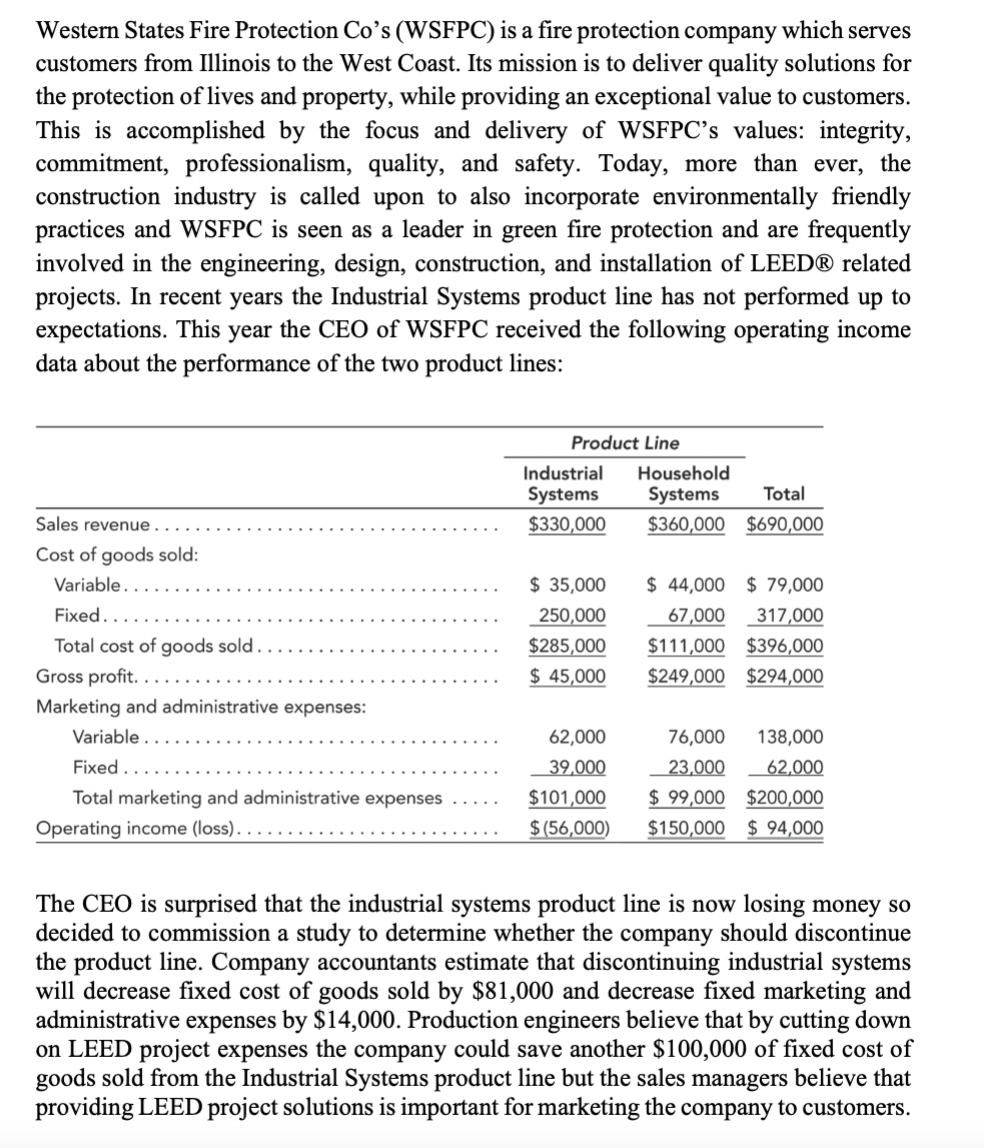

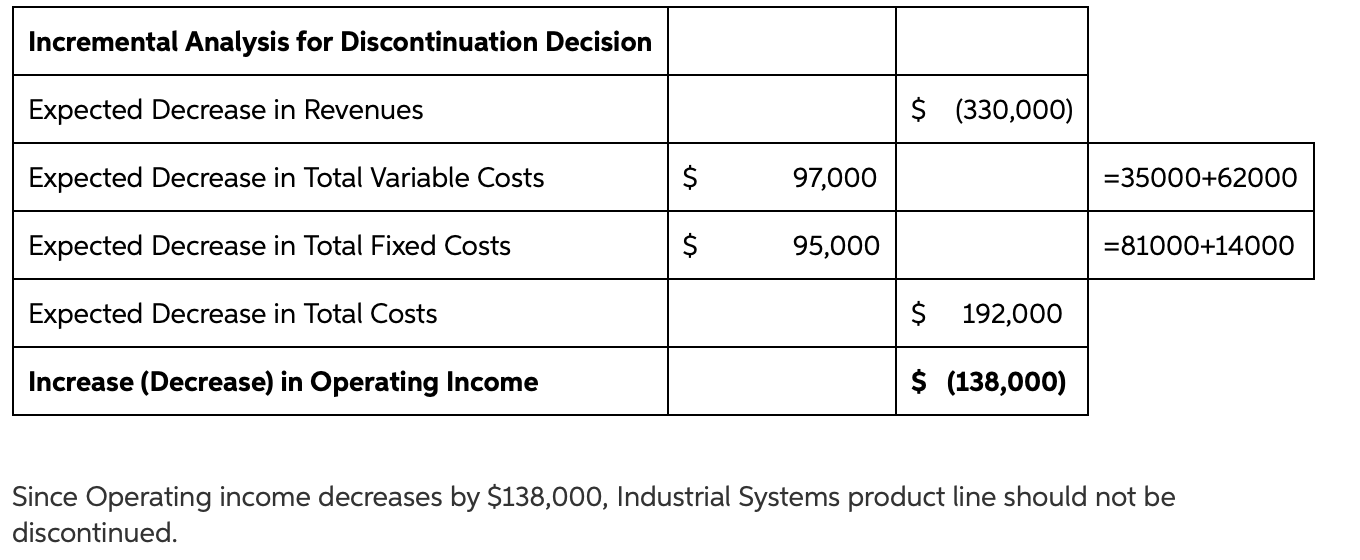

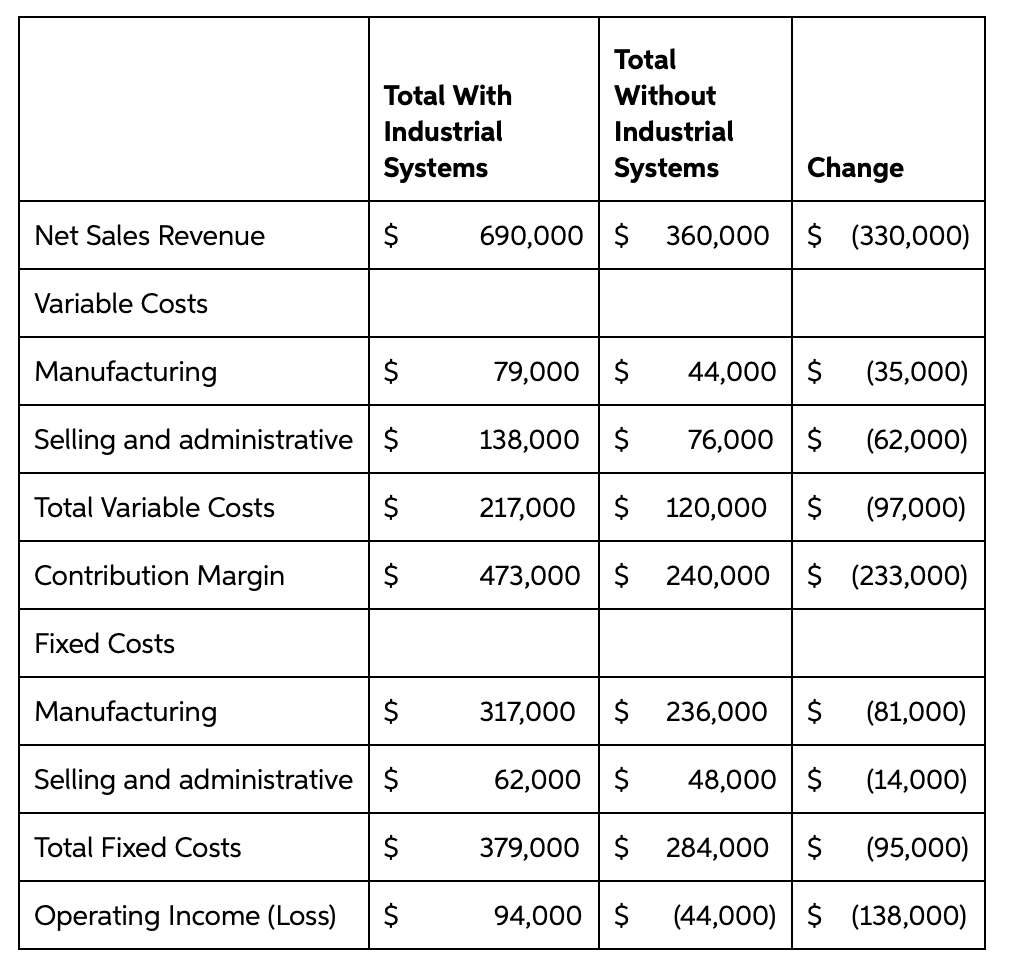

Western States Fire Protection Co's (WSFPC) is a fire protection company which serves customers from Illinois to the West Coast. Its mission is to deliver quality solutions for the protection of lives and property, while providing an exceptional value to customers. This is accomplished by the focus and delivery of WSFPC's values: integrity, commitment, professionalism, quality, and safety. Today, more than ever, the construction industry is called upon to also incorporate environmentally friendly practices and WSFPC is seen as a leader in green fire protection and are frequently involved in the engineering, design, construction, and installation of LEED related projects. In recent years the Industrial Systems product line has not performed up to expectations. This year the CEO of WSFPC received the following operating income data about the performance of the two product lines: Product Line Industrial Household Systems Systems Total $330,000 $360,000 $690,000 Sales revenue Cost of goods sold: Variable... Fixed..... Total cost of goods sold. Gross profit... Marketing and administrative expenses: Variable .. Fixed .. Total marketing and administrative expenses Operating income (loss). $ 35,000 250,000 $285,000 $ 45,000 $ 44,000 $ 79,000 67,000 317,000 $111,000 $396,000 $249,000 $294,000 62,000 39,000 $101,000 $(56,000) 76,000 138,000 23,000 62,000 $ 99,000 $200,000 $150,000 $ 94,000 The CEO is surprised that the industrial systems product line is now losing money so decided to commission a study to determine whether the company should discontinue the product line. Company accountants estimate that discontinuing industrial systems will decrease fixed cost of goods sold by $81,000 and decrease fixed marketing and administrative expenses by $14,000. Production engineers believe that by cutting down on LEED project expenses the company could save another $100,000 of fixed cost of goods sold from the Industrial Systems product line but the sales managers believe that providing LEED project solutions is important for marketing the company to customers. Incremental Analysis for Discontinuation Decision Expected Decrease in Revenues $ (330,000) Expected Decrease in Total Variable Costs $ 97,000 =35000+62000 Expected Decrease in Total Fixed Costs $ 95,000 =81000+14000 Expected Decrease in Total Costs $ 192,000 Increase (Decrease) in Operating Income $ (138,000) Since Operating income decreases by $138,000, Industrial Systems product line should not be discontinued. Total With Industrial Systems Total Without Industrial Systems Change Net Sales Revenue $ 690,000$ 360,000$ (330,000) Variable Costs Manufacturing $ 79,000 $ 44,000 $ (35,000) Selling and administrative $ 138,000 $ 76,000 $ (62,000) Total Variable Costs $ 217,000 $ 120,000 $ (97,000) Contribution Margin $ 473,000$ 240,000$ (233,000) Fixed Costs Manufacturing $ 317,000 $ 236,000 $ (81,000) Selling and administrative $ 62,000 $ 48,000 $ (14,000) Total Fixed Costs $ 379,000$ 284,000 $ (95,000) Operating Income (Loss) $ 94,000 $ (44,000) $ (138,000) Western States Fire Protection Co's (WSFPC) is a fire protection company which serves customers from Illinois to the West Coast. Its mission is to deliver quality solutions for the protection of lives and property, while providing an exceptional value to customers. This is accomplished by the focus and delivery of WSFPC's values: integrity, commitment, professionalism, quality, and safety. Today, more than ever, the construction industry is called upon to also incorporate environmentally friendly practices and WSFPC is seen as a leader in green fire protection and are frequently involved in the engineering, design, construction, and installation of LEED related projects. In recent years the Industrial Systems product line has not performed up to expectations. This year the CEO of WSFPC received the following operating income data about the performance of the two product lines: Product Line Industrial Household Systems Systems Total $330,000 $360,000 $690,000 Sales revenue Cost of goods sold: Variable... Fixed..... Total cost of goods sold. Gross profit... Marketing and administrative expenses: Variable .. Fixed .. Total marketing and administrative expenses Operating income (loss). $ 35,000 250,000 $285,000 $ 45,000 $ 44,000 $ 79,000 67,000 317,000 $111,000 $396,000 $249,000 $294,000 62,000 39,000 $101,000 $(56,000) 76,000 138,000 23,000 62,000 $ 99,000 $200,000 $150,000 $ 94,000 The CEO is surprised that the industrial systems product line is now losing money so decided to commission a study to determine whether the company should discontinue the product line. Company accountants estimate that discontinuing industrial systems will decrease fixed cost of goods sold by $81,000 and decrease fixed marketing and administrative expenses by $14,000. Production engineers believe that by cutting down on LEED project expenses the company could save another $100,000 of fixed cost of goods sold from the Industrial Systems product line but the sales managers believe that providing LEED project solutions is important for marketing the company to customers. Incremental Analysis for Discontinuation Decision Expected Decrease in Revenues $ (330,000) Expected Decrease in Total Variable Costs $ 97,000 =35000+62000 Expected Decrease in Total Fixed Costs $ 95,000 =81000+14000 Expected Decrease in Total Costs $ 192,000 Increase (Decrease) in Operating Income $ (138,000) Since Operating income decreases by $138,000, Industrial Systems product line should not be discontinued. Total With Industrial Systems Total Without Industrial Systems Change Net Sales Revenue $ 690,000$ 360,000$ (330,000) Variable Costs Manufacturing $ 79,000 $ 44,000 $ (35,000) Selling and administrative $ 138,000 $ 76,000 $ (62,000) Total Variable Costs $ 217,000 $ 120,000 $ (97,000) Contribution Margin $ 473,000$ 240,000$ (233,000) Fixed Costs Manufacturing $ 317,000 $ 236,000 $ (81,000) Selling and administrative $ 62,000 $ 48,000 $ (14,000) Total Fixed Costs $ 379,000$ 284,000 $ (95,000) Operating Income (Loss) $ 94,000 $ (44,000) $ (138,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts