Question: 1) Please solve all the questions, and please write the question number before answering, I just want the answer code please help.I will not forget

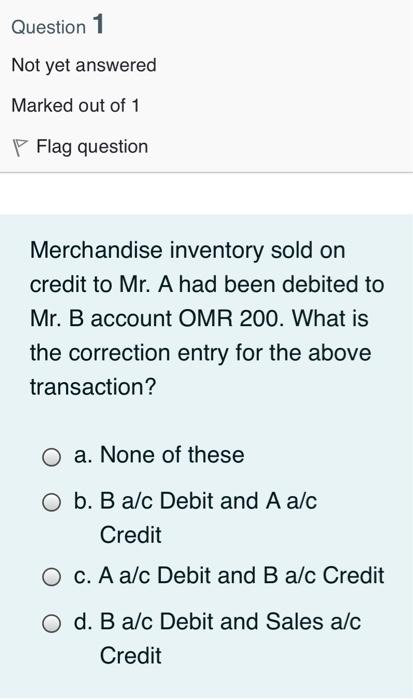

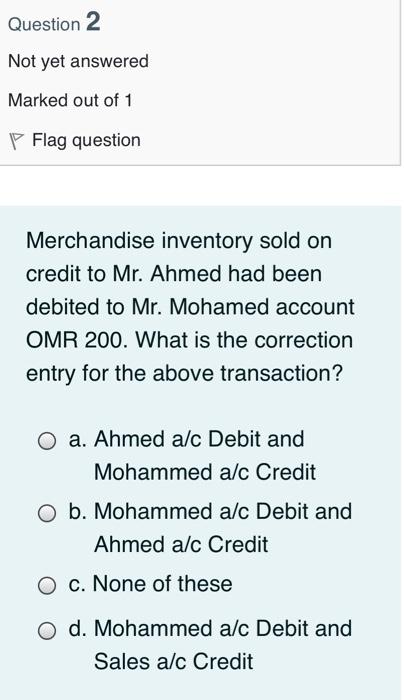

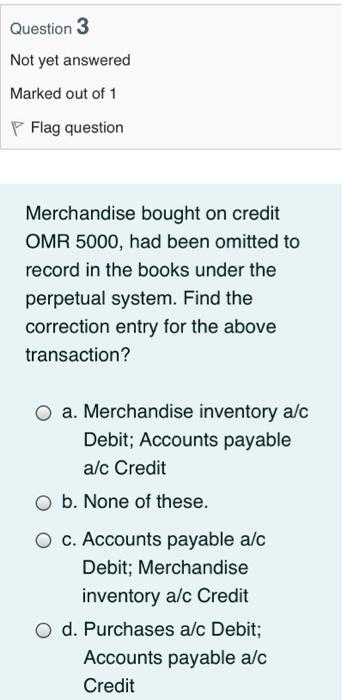

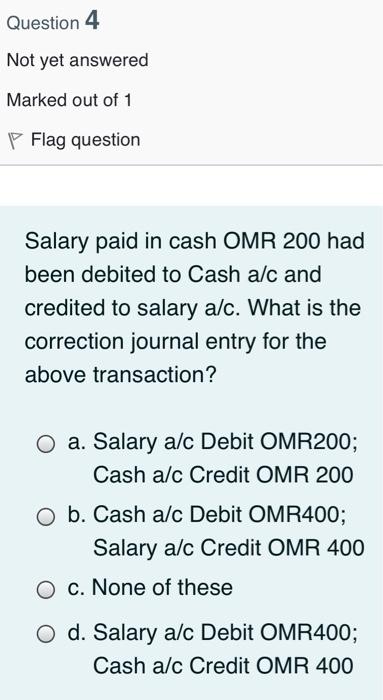

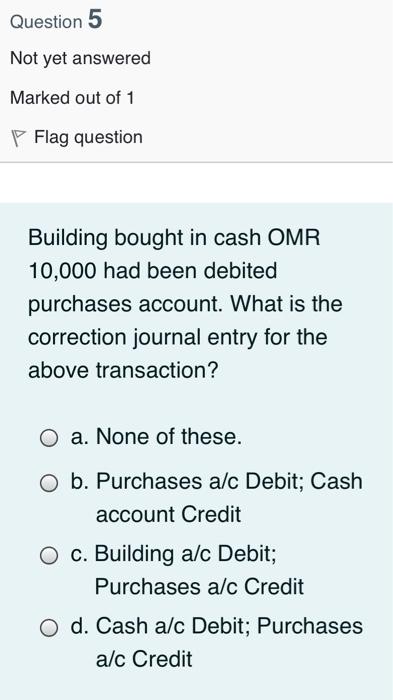

Question 1 Not yet answered Marked out of 1 P Flag question Merchandise inventory sold on credit to Mr. A had been debited to Mr. B account OMR 200. What is the correction entry for the above transaction? O a. None of these O b. B a/c Debit and A a/c Credit O c. A a/c Debit and B a/c Credit O d. B a/c Debit and Sales a/c Credit Question 2 Not yet answered Marked out of 1 P Flag question Merchandise inventory sold on credit to Mr. Ahmed had been debited to Mr. Mohamed account OMR 200. What is the correction entry for the above transaction? O a. Ahmed a/c Debit and Mohammed a/c Credit O b. Mohammed a/c Debit and Ahmed a/c Credit O c. None of these O d. Mohammed a/c Debit and Sales a/c Credit Question 3 Not yet answered Marked out of 1 P Flag question Merchandise bought on credit OMR 5000, had been omitted to record in the books under the perpetual system. Find the correction entry for the above transaction? a. Merchandise inventory a/c Debit; Accounts payable a/c Credit b. None of these. O c. Accounts payable a/c Debit; Merchandise inventory a/c Credit O d. Purchases a/c Debit; Accounts payable a/c Credit Question 4 Not yet answered Marked out of 1 Flag question Salary paid in cash OMR 200 had been debited to Cash a/c and credited to salary a/c. What is the correction journal entry for the above transaction? O a. Salary a/c Debit OMR200; Cash a/c Credit OMR 200 b. Cash a/c Debit OMR400; Salary a/c Credit OMR 400 O c. None of these O d. Salary a/c Debit OMR400; Cash a/c Credit OMR 400 Question 5 Not yet answered Marked out of 1 P Flag question Building bought in cash OMR 10,000 had been debited purchases account. What is the correction journal entry for the above transaction? O a. None of these. b. Purchases a/c Debit; Cash account Credit O c. Building a/c Debit; Purchases a/c Credit O d. Cash a/c Debit; Purchases a/c Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts