Question: 1. Please use a position in the underlying asset and cash borrowing or lending at risk-free rate to construct a replicating portfolio for a short

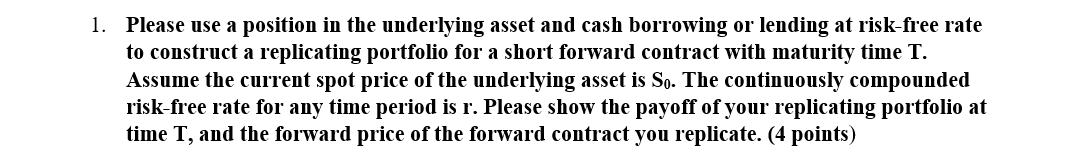

1. Please use a position in the underlying asset and cash borrowing or lending at risk-free rate to construct a replicating portfolio for a short forward contract with maturity time T. Assume the current spot price of the underlying asset is So. The continuously compounded risk-free rate for any time period is r. Please show the payoff of your replicating portfolio at time T, and the forward price of the forward contract you replicate. (4 points) 1. Please use a position in the underlying asset and cash borrowing or lending at risk-free rate to construct a replicating portfolio for a short forward contract with maturity time T. Assume the current spot price of the underlying asset is So. The continuously compounded risk-free rate for any time period is r. Please show the payoff of your replicating portfolio at time T, and the forward price of the forward contract you replicate. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts