Question: 1 point Comparing cash flows occurring at different points in time is like comparing apples to oranges. How do you make a decision concerning such

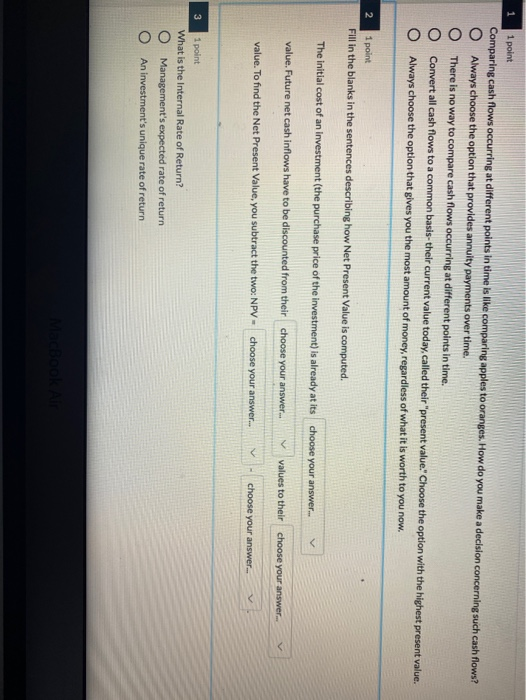

1 point Comparing cash flows occurring at different points in time is like comparing apples to oranges. How do you make a decision concerning such cash flows? O Always choose the option that provides annuity payments over time. There is no way to compare cash flows occurring at different points in time. Convert all cash flows to a common basis-their current value today,called their present value." Choose the option with the highest present value. O Always choose the option that gives you the most amount of money, regardless of what it is worth to you now 1 point Fill in the blanks in the sentences describing how Net Present Value is computed. The initial cost of an investment (the purchase price of the investment) is already at its choose your answer... value. Future net cash inflows have to be discounted from their choose your answer.. values to their choose your answer... value. To find the Net Present Value, you subtract the two: NPV - choose your answer... - choose your answer... 1 point What is the Internal Rate of Return? O Management's expected rate of return O An investment's unique rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts