Question: (1 point) Consider a $1000 par value bond that pays 8 annual coupons at a nominal rate of 5% compounded annually. Suppose that the bond

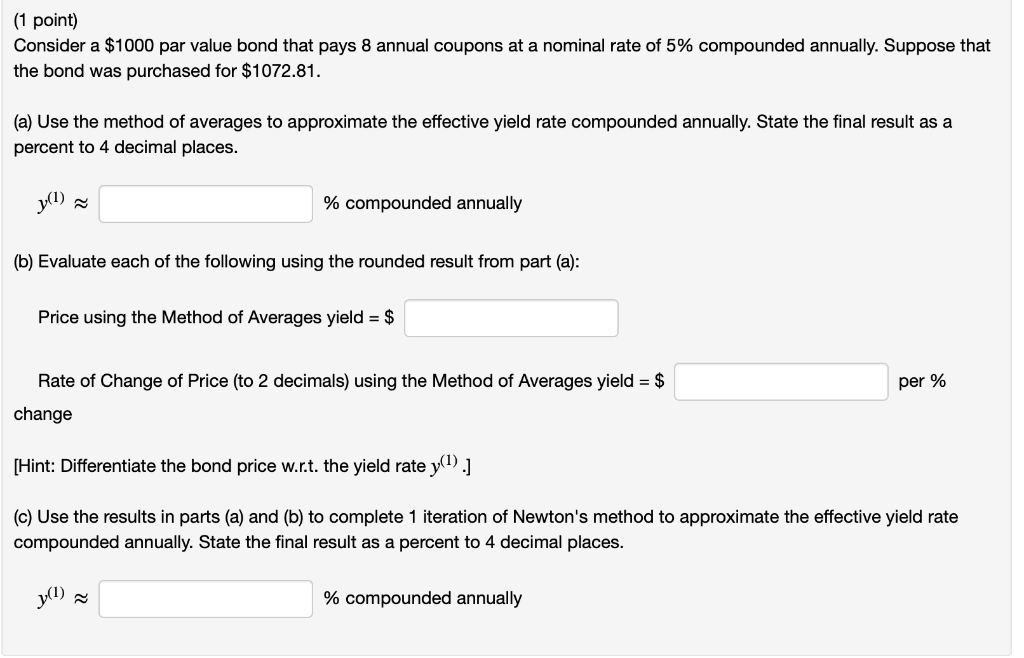

(1 point) Consider a $1000 par value bond that pays 8 annual coupons at a nominal rate of 5% compounded annually. Suppose that the bond was purchased for $1072.81. (a) Use the method of averages to approximate the effective yield rate compounded annually. State the final result as a percent to 4 decimal places. % compounded annually (b) Evaluate each of the following using the rounded result from part (a): Price using the Method of Averages yield = $ Rate of Change of Price (to 2 decimals) using the Method of Averages yield = $ per % change [Hint: Differentiate the bond price w.rt. the yield rate y().] (c) Use the results in parts (a) and (b) to complete 1 iteration of Newton's method to approximate the effective yield rate compounded annually. State the final result as a percent to 4 decimal places. y(l) % compounded annually (1 point) Consider a $1000 par value bond that pays 8 annual coupons at a nominal rate of 5% compounded annually. Suppose that the bond was purchased for $1072.81. (a) Use the method of averages to approximate the effective yield rate compounded annually. State the final result as a percent to 4 decimal places. % compounded annually (b) Evaluate each of the following using the rounded result from part (a): Price using the Method of Averages yield = $ Rate of Change of Price (to 2 decimals) using the Method of Averages yield = $ per % change [Hint: Differentiate the bond price w.rt. the yield rate y().] (c) Use the results in parts (a) and (b) to complete 1 iteration of Newton's method to approximate the effective yield rate compounded annually. State the final result as a percent to 4 decimal places. y(l) % compounded annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts