Question: (1 point) Consider a forward contract on a commodity with a current price of $2800 and delivery time in 4 months. Assume that the

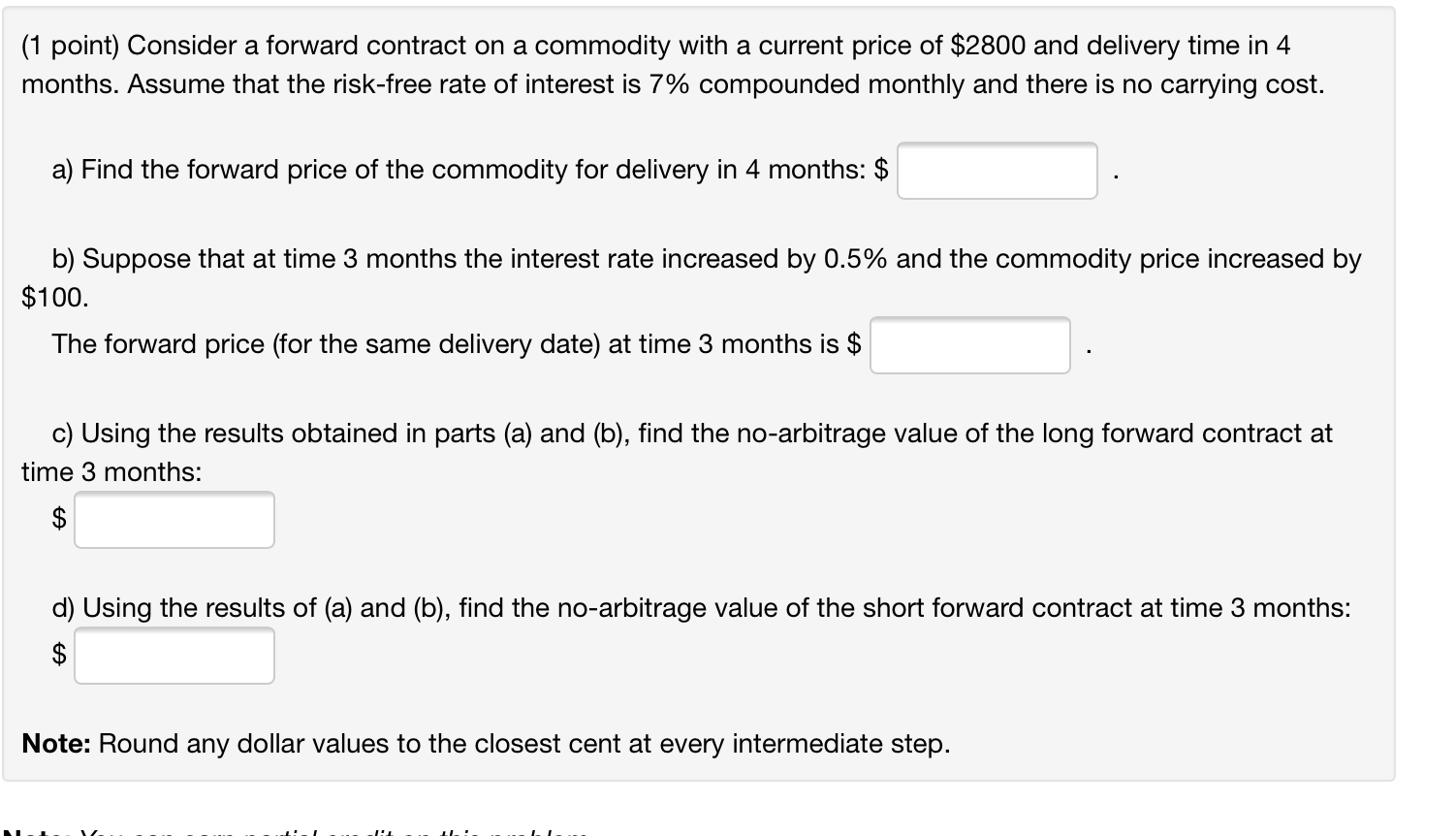

(1 point) Consider a forward contract on a commodity with a current price of $2800 and delivery time in 4 months. Assume that the risk-free rate of interest is 7% compounded monthly and there is no carrying cost. a) Find the forward price of the commodity for delivery in 4 months: $ b) Suppose that at time 3 months the interest rate increased by 0.5% and the commodity price increased by $100. The forward price (for the same delivery date) at time 3 months is $ c) Using the results obtained in parts (a) and (b), find the no-arbitrage value of the long forward contract at time 3 months: $ d) Using the results of (a) and (b), find the no-arbitrage value of the short forward contract at time 3 months: $ Note: Round any dollar values to the closest cent at every intermediate step.

Step by Step Solution

There are 3 Steps involved in it

To solve this problem well use the formula for calculating the forward price of a commodity Forward ... View full answer

Get step-by-step solutions from verified subject matter experts