Question: (1 point) Consider a portfolio maturing in 7 months that consists of 2 shares of a risky stock and 6 units of a risk-free bond.

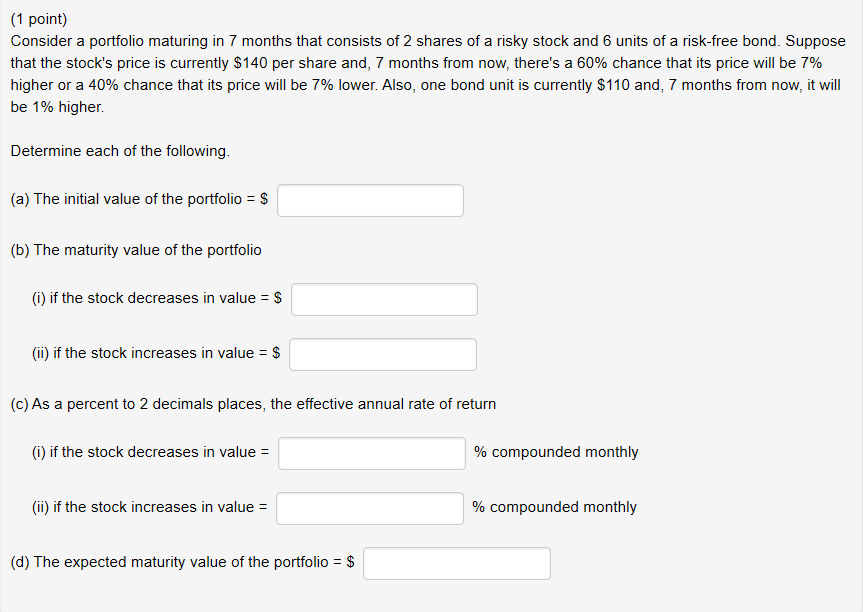

(1 point) Consider a portfolio maturing in 7 months that consists of 2 shares of a risky stock and 6 units of a risk-free bond. Suppose that the stock's price is currently $140 per share and, 7 months from now, there's a 60% chance that its price will be 7% higher or a 40% chance that its price will be 7% lower. Also, one bond unit is currently $110 and, 7 months from now, it will be 1% higher Determine each of the following. (a) The initial value of the portfolio = $ (b) The maturity value of the portfolio (i) if the stock decreases in value = $ (i) if the stock increases in value = $ (c) As a percent to 2 decimals places, the effective annual rate of return (i) if the stock decreases in value = % compounded monthly (ii) if the stock increases in value = % compounded monthly (d) The expected maturity value of the portfolio = $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts