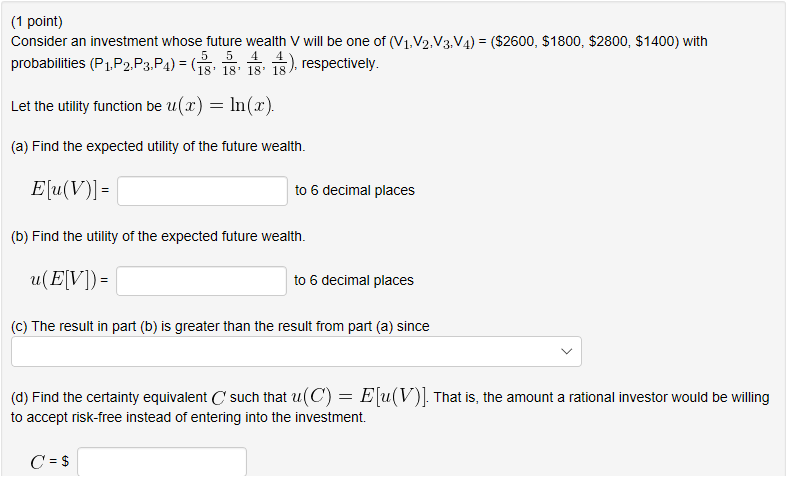

Question: (1 point) Consider an investment whose future wealth V will be one of (V1.V2,V3,V4) probabilities (P1,P2PaP4)-G, 18, ), res ($2600, $1800, $2800, $1400) with ,

(1 point) Consider an investment whose future wealth V will be one of (V1.V2,V3,V4) probabilities (P1,P2PaP4)-G, 18, ), res ($2600, $1800, $2800, $1400) with , . ), respectively Let the utility function be u(x) - In(zr (a) Find the expected utility of the future wealth. to 6 decimal places (b) Find the utility of the expected future wealth. u(EV) to 6 decimal places (c) The result in part (b) is greater than the result from part (a) since (d) Find the certainty equivalent C such that u (C-Ela(V)]. That is, the amount a rational investor would be willing to accept risk-free instead of entering into the investment. C-S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts