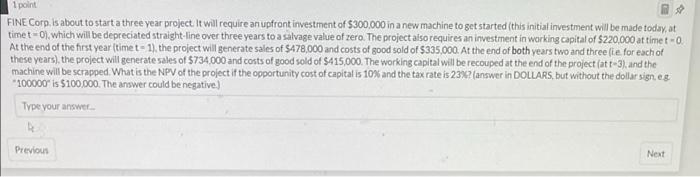

Question: 1 point FINE Corp. is about to start a three year project. It will require an upfront investment of $300,000 in a new machine to

1 point FINE Corp. is about to start a three year project. It will require an upfront investment of $300,000 in a new machine to get started (this initial investment will be made today, at timet - 0), which will be depreciated straight-line over three years to a salvage value of zero. The project also requires an investment in working capital of $220.000 at time to At the end of the first year (timet-1), the project will generate sales of $478,000 and costs of good sold of $335,000. At the end of both years two and three die for each of these years), the project will generate sales of $734000 and costs of good sold of $415,000. The working capital will be recouped at the end of the project (att-3), and the machine will be scrapped What is the NPV of the project if the opportunity cost of capital is 10% and the tax rate is 2380 (answer in DOLLARS, but without the dollar sign, eg *100000" is $100,000. The answer could be negative) Type your answer Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts