Question: 1 Point Question 20 If two projects have the same expected value of cash flows, but different standard deviations, then the riskier project is the

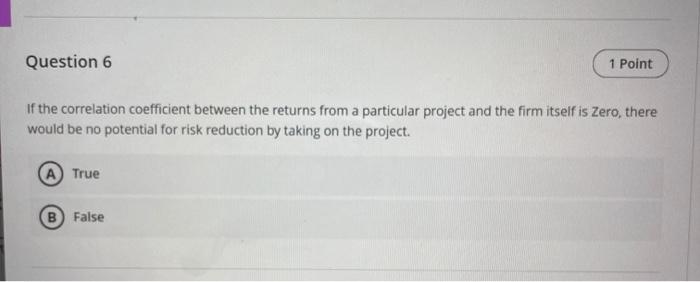

1 Point Question 20 If two projects have the same expected value of cash flows, but different standard deviations, then the riskier project is the one with the larger standard deviation A True B) False Question 17 1 Point The benefits to be expected from a new project are projected as income flow rather than as cash flows. A True B) False Question 13 1 Point The use of probability trees allows an analyst to specify future cash flows in terms of outcomes in prior periods. A True B) False Question 8 1 Point When comparing two potential projects with different initial cash outflows, this scale difference can cause potential conflicting rankings when comparing internal rate of return, net present value, or profitability index. A True B False Question 6 1 Point If the correlation coefficient between the returns from a particular project and the firm itself is Zero, there would be no potential for risk reduction by taking on the project. A True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts