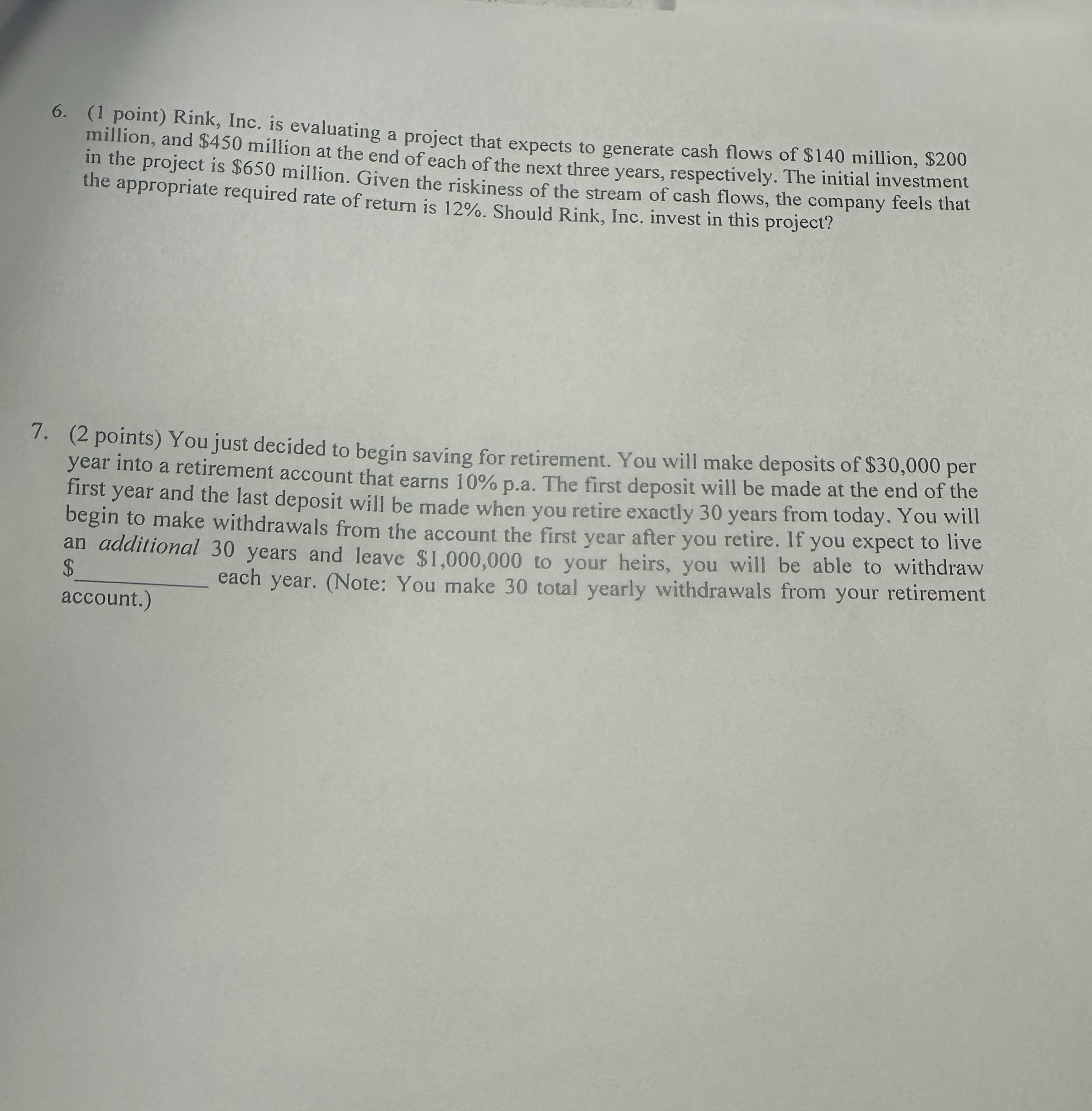

Question: ( 1 point ) Rink, Inc. is evaluating a project that expects to generate cash flows of $ 1 4 0 million, $ 2 0

point Rink, Inc. is evaluating a project that expects to generate cash flows of $ million, $ million, and $ million at the end of each of the next three years, respectively. The initial investment in the project is $ million. Given the riskiness of the stream of cash flows, the company feels that the appropriate required rate of return is Should Rink, Inc. invest in this project?

points You just decided to begin saving for retirement. You will make deposits of $ per year into a retirement account that earns pa The first deposit will be made at the end of the first year and the last deposit will be made when you retire exactly years from today. You will begin to make withdrawals from the account the first year after you retire. If you expect to live an additional years and leave $ to your heirs, you will be able to withdraw $ account. each year. Note: You make total yearly withdrawals from your retirement account.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock