Question: (1 point) Suppose S = $ 40, r = 3 %, delta(the annualized dividend rate) is 5 %, sigma(the annualized standard deviation of the continously

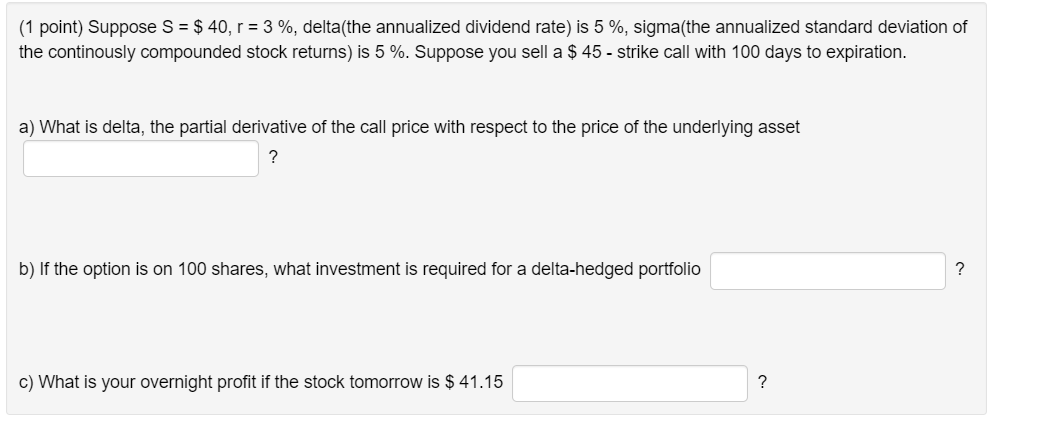

(1 point) Suppose S = $ 40, r = 3 %, delta(the annualized dividend rate) is 5 %, sigma(the annualized standard deviation of the continously compounded stock returns) is 5 %. Suppose you sell a $ 45 - strike call with 100 days to expiration. a) What is delta, the partial derivative of the call price with respect to the price of the underlying asset b) If the option is on 100 shares, what investment is required for a delta-hedged portfolio c) What is your overnight profit if the stock tomorrow is $ 41.15 (1 point) Suppose S = $ 40, r = 3 %, delta(the annualized dividend rate) is 5 %, sigma(the annualized standard deviation of the continously compounded stock returns) is 5 %. Suppose you sell a $ 45 - strike call with 100 days to expiration. a) What is delta, the partial derivative of the call price with respect to the price of the underlying asset b) If the option is on 100 shares, what investment is required for a delta-hedged portfolio c) What is your overnight profit if the stock tomorrow is $ 41.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts