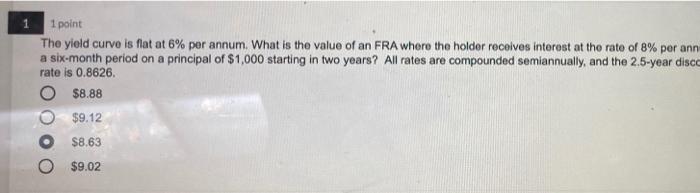

Question: 1 point The yield curvo is flat at 6% per annum. What is the value of an FRA where the holder receives interest at the

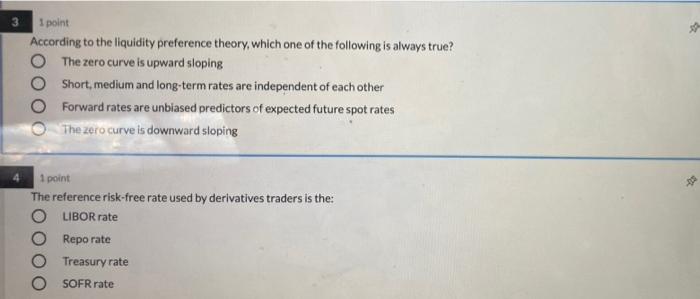

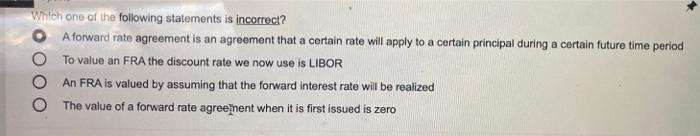

1 point The yield curvo is flat at 6% per annum. What is the value of an FRA where the holder receives interest at the rate of 8% per ann a six-month period on a principal of $1,000 starting in two years? All rates are compounded semiannually, and the 2.5-year disc rate is 0.8626. $8.88 $9.12 $8.63 O $9.02 3 point According to the liquidity preference theory, which one of the following is always true? The zero curve is upward sloping O Short, medium and long-term rates are independent of each other Forward rates are unbiased predictors of expected future spot rates The zero curve is downward sloping - 1 point The reference risk-free rate used by derivatives traders is the: O LIBOR rate Repo rate Treasury rate SOFR rate Which one of the following statements is incorrect? A forward rate agreement is an agreement that a certain rate will apply to a certain principal during a certain future time period To value an FRA the discount rate we now use is LIBOR An FRA is valued by assuming that the forward interest rate will be realized The value of a forward rate agree nent when it is first issued is zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts