Question: (1 point) Two 1000 dollar face value bonds are both redeemable at par, with the first having a redemption date 3 years prior to the

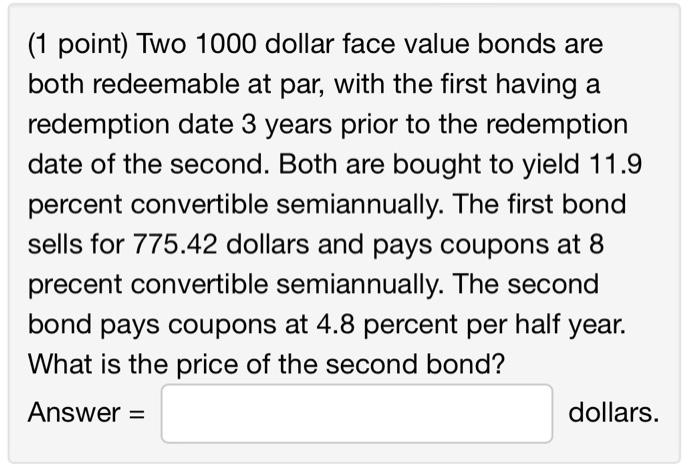

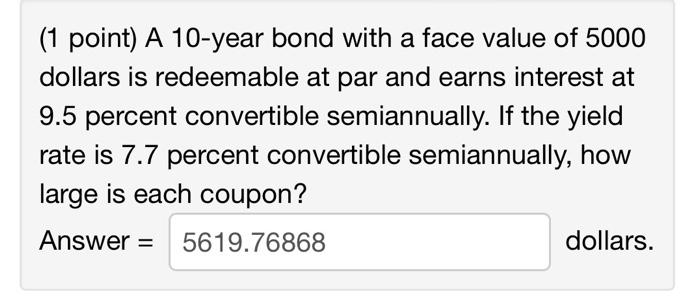

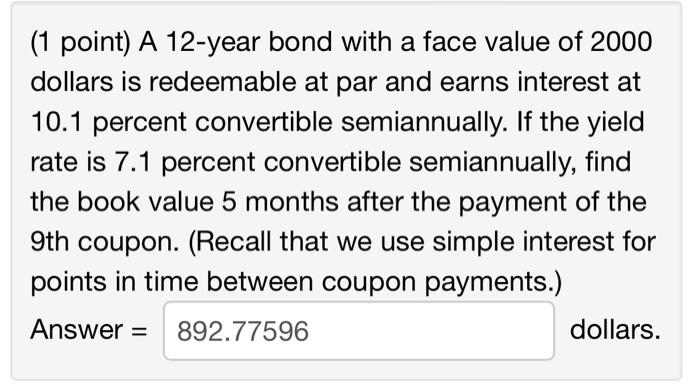

(1 point) Two 1000 dollar face value bonds are both redeemable at par, with the first having a redemption date 3 years prior to the redemption date of the second. Both are bought to yield 11.9 percent convertible semiannually. The first bond sells for 775.42 dollars and pays coupons at 8 precent convertible semiannually. The second bond pays coupons at 4.8 percent per half year. What is the price of the second bond? Answer = dollars. (1 point) A 10-year bond with a face value of 5000 dollars is redeemable at par and earns interest at 9.5 percent convertible semiannually. If the yield rate is 7.7 percent convertible semiannually, how large is each coupon? Answer = 5619.76868 dollars. = (1 point) A 12-year bond with a face value of 2000 dollars is redeemable at par and earns interest at 10.1 percent convertible semiannually. If the yield rate is 7.1 percent convertible semiannually, find the book value 5 months after the payment of the 9th coupon. (Recall that we use simple interest for points in time between coupon payments.) Answer 892.77596 dollars. =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts