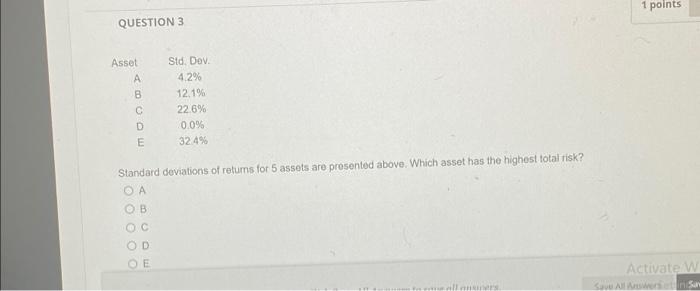

Question: 1 points QUESTION 3 Asset B Sid. Dev. 4.2% 12.1% 22.6% 0.0% 32.4% C D E Standard deviations of retums for 5 assets are presented

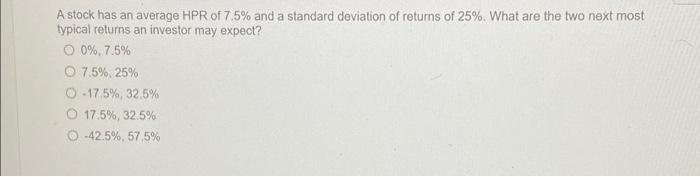

1 points QUESTION 3 Asset B Sid. Dev. 4.2% 12.1% 22.6% 0.0% 32.4% C D E Standard deviations of retums for 5 assets are presented above. Which asset has the highest total risk? OA OB OD E Activate w SAS A stock has an average HPR of 7.5% and a standard deviation of returns of 25%. What are the two next most typical returns an investor may expect? O 0%, 7.5% O 7.5% 25% 0-17.5%, 32.5% 17.5%, 32.5% -42.5%, 57,5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts