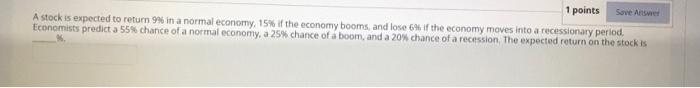

Question: 1 points Save Answer A stock is expected to return 9% in a normal economy, 15% if the economy booms and lose 6% if the

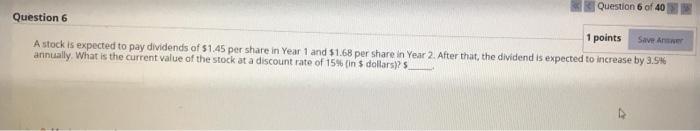

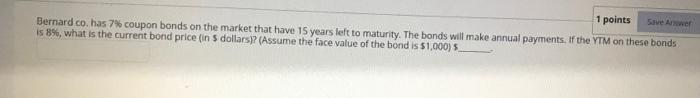

1 points Save Answer A stock is expected to return 9% in a normal economy, 15% if the economy booms and lose 6% if the economy moves into a recessionary period. Economists predict a 55% chance of a normal economy, a 25% chance of a boom and a 20% chance of a recession. The expected return on the stock is Question 6 of 40 Question 6 1 points Save A A stock is expected to pay dividends of $1.45 per share in Year 1 and 51.68 per share in Year 2. After that, the dividend is expected to increase by 3.5 annually. What is the current value of the stock at a discount rate of 154 [ins dollars)? 1 points Save Anwer Bernard cohas 7% coupon bonds on the market that have 15 years left to maturity. The bonds will make annual payments. If the YTM on these bonds is 8%, what is the current bond price (in 5 dollars? (Assume the face value of the bond is $1,000) 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts