Question: 1 points Save Answer QUESTION 1 A company plans to raise $245 million by issuing 20-year semiannual coupon bonds. Each bond has a face value

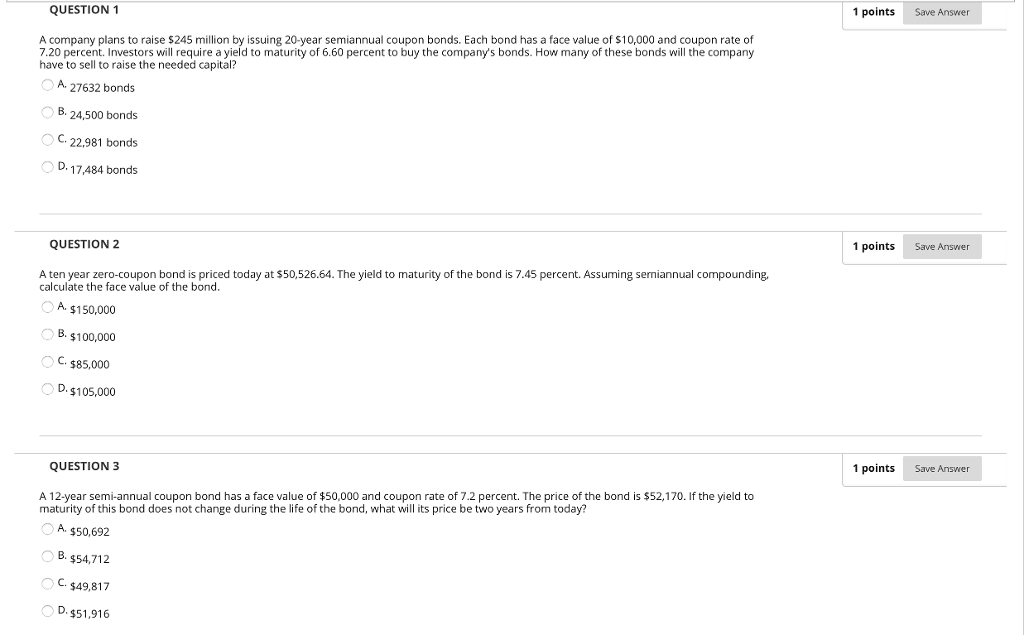

1 points Save Answer QUESTION 1 A company plans to raise $245 million by issuing 20-year semiannual coupon bonds. Each bond has a face value of $10,000 and coupon rate of 7.20 percent. Investors will require a yield to maturity of 6.60 percent to buy the company's bonds. How many of these bonds will the company have to sell to raise the needed capital? A. 27632 bonds B. 24,500 bonds C.22,981 bonds D. 17,484 bonds 1 points Save Answer QUESTION 2 A ten year zero-coupon bond is priced today at $50,526.64. The yield to maturity of the bond is 7.45 percent. Assuming semiannual compounding calculate the face value of the bond A. $150,000 B. $100,000 C. $85,000 D. $105,000 1 points Save Answer QUESTION 3 A 12-year semi-annual coupon bond has a face value of $50,000 and coupon rate of 7.2 percent. The price of the bond is $52,170. If the yield to maturity of this bond does not change during the life of the bond, what will its price be two years from today? A. $50,692 B. $54,712 C. $49,817 D. $51,916

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts